[NGW Magazine] Eni, Total Risk Turkey’s wrath

This article is featured in NGW Magazine Volume 2, Issue 16

Eni’s drilling programme offshore Cyprus takes it into conflict with Turkey, which does not recognise Cyprus’ maritime boundaries. Total is pursuing the same policy, with the same belief that it is lawful.

The energy ministry of Cyprus confirmed August 19 that Eni will kick-off its much-expected drilling campaign in Cyprus’ exclusive economic zone in November. And it is a bold move, given Turkey’s claims to waters that Cyprus says are its own.

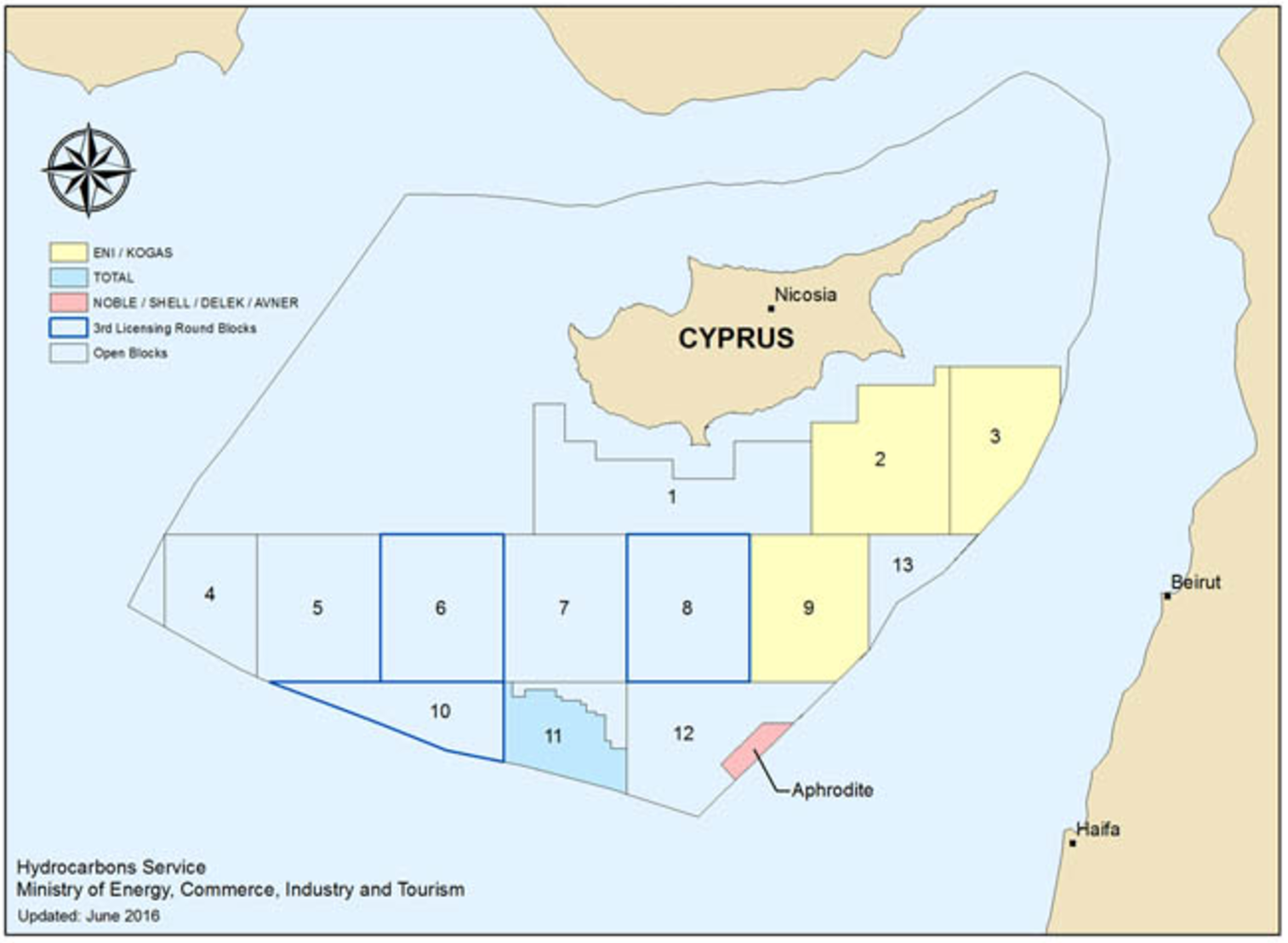

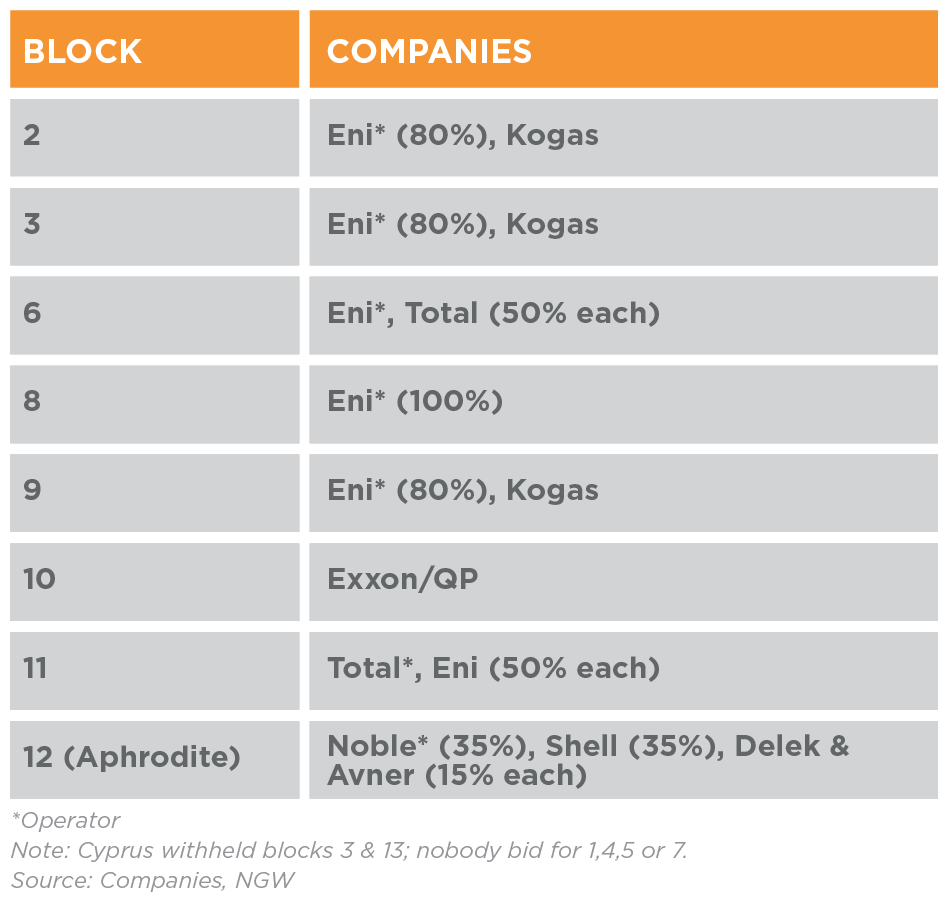

The Italian company will start its drilling at block 8 at a target named ‘Eratosthenes South 1’ (ES1), followed by Cuttlefish in block 3, owned 80% Eni and 20% by state Korea Gas Corp; and then Calypso in block 6, jointly owned with the French company, Total.

Eni has chosen to start its campaign in block 8, where the most promising prospects probably are, and is likely to complete this drilling round at block 6, thus asserting its rights to the block and confronting Turkey’s claims. However, the exact drilling programme is still to be finalised.

At the same time the energy minister Giorgos Lakkotrypis confirmed that the US major ExxonMobil is planning to drill in block 10 during the second half of 2018.

In accordance with its production sharing agreements with the government of Cyprus, Eni’s drilling programme involves two wells in total in blocks 2,3 and 9 (in addition to the unsuccessful wells drilled in 2014-2015) and two in block 8 and one in block 6, making five in all. Should this lead to commercial hydrocarbon discoveries, the number of wells to be drilled may be doubled to ten, as a result of additional appraisal drilling to confirm hydrocarbon quantities.

Eni is progressing the submission of documentation to government agencies that is needed before it can receive environmental, safety and other approvals, needed to start drilling ES1.

It should be pointed out that the areas around the long-submerged Mt Eratosthenes are considered to be particularly sensitive environmentally, requiring special attention. It is expected that this process will be completed by September.

Based on the seismic data released by the ministry during the third licensing round, there are good indications of that hydrocarbons are present in block 8 in carbonate formations similar to Zohr offshore Egypt, which Eni, as the discoverer, knows well. So, it is not surprising that Eni is likely to start its campaign with this block.

ES1 lies about 128 km south of Limassol, close to the subsea Mt Eratosthenes, at 1,930 m water-depth and about 3,300 m below seabed. Drilling will be performed by the Saipem-12000 ultra-deep drillrig, which is eminently suitable for the water and well-depths expected during this campaign which is scheduled to last 36 days. Eni’s drilling support base will be at Limassol port.

Detailed surveys of the seabed around ES1 have revealed archaeological finds in the form of pottery and other objects. In order to avoid disturbing these, Eni moved ES1 about 1 km away from the initially chosen location.

In the process of finalising its drilling programme, Eni will have the benefit of the results from drilling in the nearby block 11, which should be completed in September. This is jointly owned with Total and as a result, it can take this additional information into account when finalizing its plans to drill ES1.

If all goes to plan, drilling will continue at the Cuttlefish target in block 3 and at Calypso in block 6. This could not only coincide with the period of the presidential elections in Cyprus in February, but the ownership of block 6 is hotly disputed by Turkey.

Offshore Cyprus exploration blocks (Map credit: Ministry of Energy, Commerce, Industry and Tourism)

Geopolitical challenges

Turkey’s claims to part of Cyprus’ exclusive economic zone (EEZ) are well known. Turkey disputes Cyprus rights to its EEZ, and in addition it is claiming parts of blocks 1,4,5,6 and 7. It considers any activities by Cyprus in block 7 and west of it to be a ‘red-line’, which will cause it to ‘intervene’.

Turkey claims about half of block 6 and in fact it carried out its own seismic surveys in the block in July, using its own seismic survey vessel Barbaros. Turkey’s energy minister Berat Albayrak, has already declared that Turkey is in the process of buying its own drilling vessel, determined to drill in the eastern Mediterranean before the year is over, but he has not indicated where.

Clearly Turkey is taking aggressive measures to support its claims. These attempts should not be under-estimated. The key international convention that establishes sovereignty over territorial seas, and rights in continental shelves and EEZ, is the United Nations law of the seas (Unclos). It provides a legal framework for the signatory countries for ownership rights and jurisdiction concerning these areas.

The legal framework covers, among others, rights to natural resources in these areas, for the purpose of exploring and exploiting them, right to exercise jurisdiction over them, controls to protect and preserve the marine environment in them, and claims for compensation. Unclos has been ratified by 167 states, and it is recognised by the US and EU, but not by Turkey, Israel or Syria.

Cyprus proclaimed its EEZ in accordance to Unclos and launched this with the UN in 2004. It subsequently entered into bi-lateral EEZ boundary agreements with all its neighbours, but not Turkey. Some of these agreements have been fully ratified, other approvals are being held up by disputes not involving Cyprus.

Cyprus claim to its EEZ is recognized by the EU, the US and the international community. It is on this basis that Cyprus has successfully conducted offshore licensing rounds and exploration of the licensed blocks, with the participation of major, reputable, international oil companies.

Turkey claims that its continental shelf has precedence and that islands, such as Cyprus, are not entitled to full EEZs. It claims that the capacity of islands to generate maritime zones should be limited in competition with the continental coastal states. Turkey claims that its EEZ should be coextensive with its continental shelf, and defined this in notes it submitted to the UN in March 2004 and March 2013.

Turkey takes the view that relative lengths of adjacent coastlines should govern EEZ delimitation in the eastern Mediterranean in adjusting the equidistant line for maritime delimitation. As a result of this, it claims that as its coastline is more than twenty times longer than that of Cyprus, the latter’s EEZ toward the west of the island should only be co-extensive with its 12-mile-wide territorial waters.

Recently Turkey’s president, Recep Tayyip Erdogan, told the oil companies to be careful they did not lose a ‘friend’ by participating in the exploitation of hydrocarbon deposits around Cyprus. And his prime minister, Binali Yildirim, called Cyprus’ moves “untimely and dangerous.”

Turkey’s intimidation increased following the collapse of the Crans-Montana negotiations to re-unify Cyprus and it has even threatened to take stronger measures on its own, to the point of direct interference in the internal affairs of Cyprus.

ENI’s business in Turkey is limited to marketing of natural gas. It sells gas supplied from Russia and transported via the Blue Stream pipeline, with sales in 2016 amounting to 6.55 bn m³.

Italy and France support Eni’s and Total’s activities in Cyprus and made their positions clearly known during recent visits to the island by their defence ministers and by frequent visits of their navies to the region. In addition, Cyprus’ claim to its EEZ is recognised by the EU, the US and the international community.

Eni has investigated in detail and has substantiated the legitimacy of Cyprus’ rights to its EEZ, both on the basis of Unclos and other relevant international conventions and agreements. On this basis Eni and Total are fully satisfied with the legitimacy of their rights to explore and exploit this and the other blocks, which they won through international competition.

Eni’s business in Turkey is limited to marketing of natural gas. It sells gas supplied from Russia and transported via the Blue Stream pipeline, last year marketing 6.5bn m³.

During her visit to Cyprus, Italy’s defence minister Roberta Pinotti told the president of Cyprus Nicos Anastasiades July 31 that “Eni is working right now (in Cyprus) and I believe that we will have a positive development for the whole of Europe.”

Intended as a message to Turkey, she added “We have to work for security and to confront difficulties and obstacles. We have to work for the future welfare of Europe within the framework of a flourishing economy.

Total, Eni undeterred

Total, through its low-profile but steady work in block 11, even under constant intimidation from Turkey, and Eni, through its bold decision to declare its intent to drill in block 6 early next year, have shown determination. Turkey’s threats so far have not changed anything. Despite tensions, the companies believe that political risk is manageable.

Blocks awarded

Anastasiades has declared that Cyprus will react strongly, through diplomatic channels, in the event that Turkey acts on its threats to drill in Cyprus’ EEZ. He said: “If the Turks violate international laws and what the Law of the Seas foresees, there will be proportionate, intense actions on the part of the Republic towards the international bodies, the Security Council and others.”

In the meanwhile, Total has moved to the next stage of its drilling at Onesiphoros in block 11, with first proof of hydrocarbons, if any, expected early September.

Success will boost prospects for more discoveries during Eni’s forthcoming drilling campaign and later in 2018 by ExxonMobil in block 10. Both Eni and ExxonMobil will be studying the results from Onesiphoros and may review and revise their drilling programmes depending on the outcome.

However, there is still a long-way between discoveries and successful exploitation through international gas sales. Global gas prices are low and the global gas market is challenging. As a result, expectations need to be managed with a dose of realism.

Charles Ellinas