National Grid Releases 10-Year and 2050 Outlooks

The UK’s National Grid launched its Gas Future Operability Plan and Gas Ten Year Statement (GTYS) in London on November 29 at an event focused on the future of gas in Britain, bringing together generators, gas shippers, network operators, policymakers and non-government groups.

The first report describes how NGrid’s operation of its National Transmission System (NTS) may need to change up to and beyond 2050, while the GTYS provides nearer-term perspective although also includes supply/demand projections out to 2040.

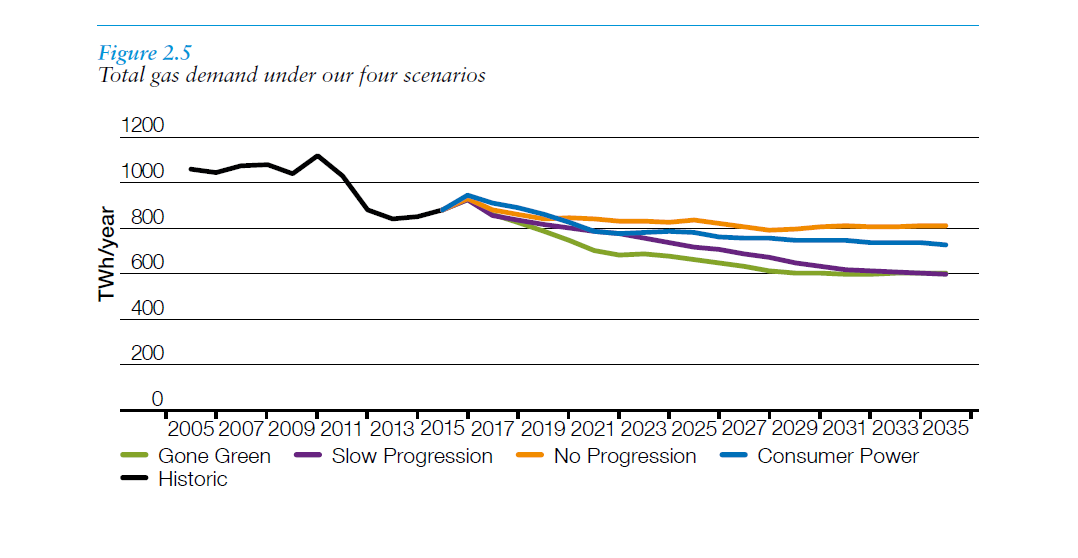

Britain’s gas demand diverges in the GTYS from around 920-940 TWh/yr (85.6bn to 87.4bn m3) in 2016 in NGrid’s scenarios -- including net flows through Interconnector UK -- to a range between 589 TWh (54.8bn m3) under the slow progression to a lower carbon economy and 809 TWh (75.2bn m3) under the 'no progression'/business as usual outlook. But in all four scenarios, it declines steadily.

Britain's gas demand declines under all four scenarios published in NGrid's Gas Ten Year Statement (GTYS) on November 29 (Graphic credit: National Grid)

Among key insights, the GTYS sees import dependency, having grown considerably since the early 2000s, potentially reaching 93% by 2040. It sees peak supply capacity staying much higher than peak demand, and does not expect peak demand to decline as sharply as annual demand. And in scenarios with a lot of renewable generation, gas-fired plant has lower utilisation but still provides back-up when wind generation is low.

In the past year, the same study notes "an increase in annual gas demand for Combined Cycle Gas Turbines (CCGTs)" but acknowledges "the behaviour of CCGTs is expected to become more unpredictable as their requirement to generate will correlate with renewable generation output (wind, solar etc) and the interaction with other balancing tools."

Nicola Shaw, NGrid UK Executive Director, said: “We’re in an era of unprecedented change in the energy sector. With the emergence of new technologies like energy storage and heat pumps, we need to consider the role of gas and the gas networks in a low carbon energy future."

“We need to ensure that the existing gas networks and assets help to provide customers’ needs while keeping bills down. We will be inviting views on the future of gas, and I encourage people to join the debate,” she added. Following this engagement and further analysis, NGrid aims to provide recommendations to government, the regulator and industry by November 2017.

Mark Smedley