Hydrogen isn’t the key to Britain’s green recovery [GasTransitions]

The EU recently published its strategy for delivering net zero carbon emissions by 2050. Alongside reducing the amount of energy consumed by buildings and industry, the appliances that currently rely on fossil fuels, like cars and domestic and industrial boilers, are to be replaced with electrical alternatives, for example batteries and heat pumps.

Where energy efficiency and electrification aren’t possible or cost effective, such as in heavy-duty transport (think trains and lorries), hydrogen fuel is expected to fill in these gaps.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

But in the UK, a large number of organisations are touting hydrogen as key to our own efforts to reach net zero carbon emissions. One recent headline blared: “The hydrogen revolution is a marvellous chance for Britain, if it does not throw away the prize”.

Much of my 45-year career in industry and academia has been spent studying energy efficiency and power production and supply. I believe that hydrogen has a limited role in decarbonisation, and that businesses with a vested interest in promoting hydrogen are doing so at the expense of British consumers.

Creating hydrogen fuel

Hydrogen has, on the face of it, much appeal. It provides power and heat with just water as a by-product. Natural gas, which currently fuels heating and cooking in 23 million UK homes, produces carbon dioxide (CO₂) when burned, thus obviously contributing to carbon emissions.

Hydrogen can also be delivered to buildings through the same pipes that currently deliver natural gas, and it can be stored for use when generation by wind and solar is limited. But it’s important to remember that hydrogen fuel, unlike natural gas, doesn’t exist in nature. It has to be manufactured.

Today, hydrogen is made from “reforming” fossil fuels. This involves using energy to convert fossil fuel into hydrogen and CO₂. To make the process carbon neutral, that CO₂ must be removed by carbon capture and storage (CCS).

An alternative to reforming is electrolysis. Here, water is cleaved into hydrogen and oxygen. This requires electricity and if this comes from renewables, then electrolysis delivers carbon-free “green hydrogen”, as it’s known.

But electrolysis costs much more than reforming, so fossil hydrogen with CCS will be the main route for production until this changes. That could be a decade or more, according to the EU, and perhaps longer if natural gas prices remain low.

Carbon-neutral homes

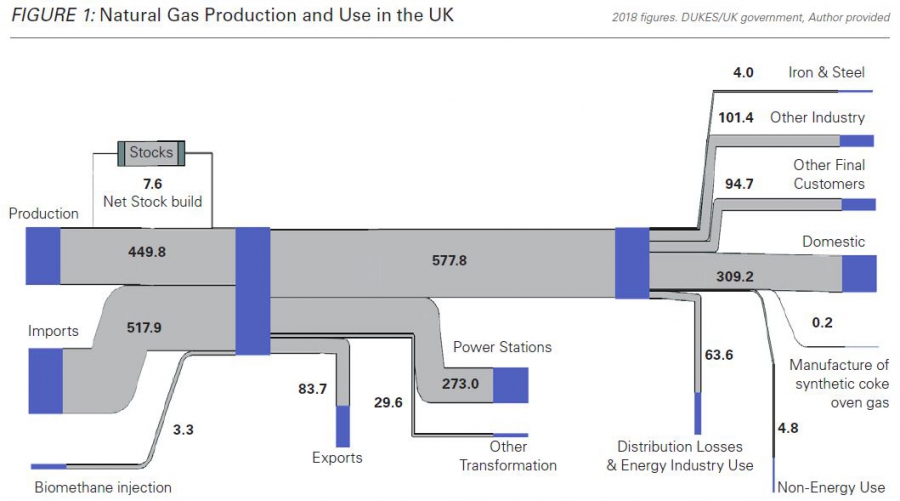

Domestic households account for 40% of all natural gas use in the UK. A large portion of the electricity made from burning natural gas is consumed by households too, making homes the UK’s largest consumer of heat and electricity. A fifth of the UK’s carbon emissions come from heating and powering homes, so making houses carbon neutral would be a huge contribution to reaching net zero emissions.

Natural gas production and use in the UK

There are no technical barriers to this. A carbon-neutral home can exist today with insulation; energy storage in hot water, batteries and solar panels; and heat pumps, which use four times less power than gas central-heating and work by extracting heat from air, soil or water using electricity.

This doesn’t require hydrogen or upgrades to gas or electricity grids, because so little electricity is needed. The power supply for heat pumps is a quarter of the size of that required for producing hydrogen. Even Centrica, a company that supplies gas for heating, has declared its support for heat pumps over hydrogen gas heating on cost grounds.

Energy storage

The next largest consumer of gas in the UK is electricity generation. So why not use green hydrogen to generate electricity?

Well, it would be very inefficient. Significant amounts of energy are lost in using electricity to produce hydrogen and then in burning hydrogen to produce electricity. And if hydrogen is synthesised from electrolysis, it stands to reason that hydrogen per kWh will cost more than the electricity it was derived from.

Some hydrogen advocates nonetheless argue that we can use surplus renewable power, particularly wind energy in the UK, to make hydrogen and store it for times when renewable supply is limited by the weather. There are, though, a wealth of means for storing energy. These include batteries; storing energy as heat captured from renewables; phase-change storage, which involves storing and then extracting energy by converting a solid into a liquid and back again; biofuels; and hydro, where elevated water is stored and pumped when energy is needed.

And if buildings are made carbon neutral with energy efficiency measures, much less power is required anyway, so the need for storage is minimised. Importing and exporting renewable energy from continental Europe would negate the need for some energy storage. As would the steady provision of power from nuclear. In other words, the energy storage issue can be addressed without hydrogen.

A new dash for gas

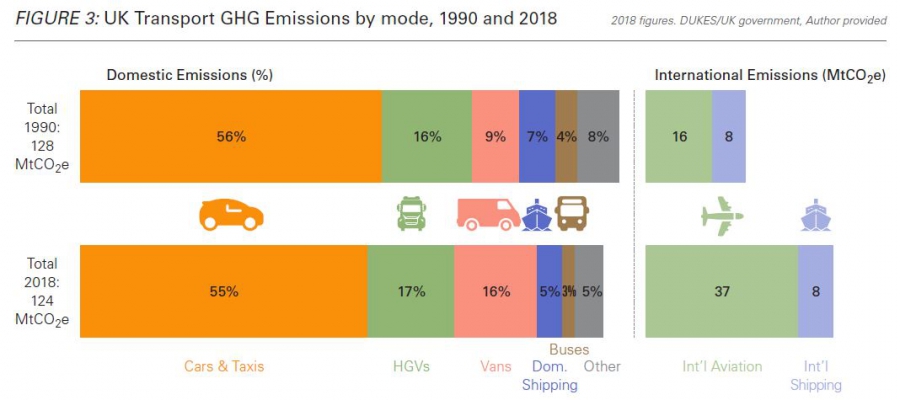

Transport is the largest single source of CO₂ emissions in the UK. Battery electric vehicles are probably the best choice to replace cars, and they are the EU’s preferred option.

But hydrogen could fuel long distance heavy haulage and shipping, where battery sizes currently limit electrification. Likewise, there are some industrial processes which will be difficult to electrify, such as cement and steel production, where hydrogen will also play a role.

But I can’t see a compelling case for hydrogen replacing natural gas as a major source of heat and power. Energy efficiency and electrification are superior options for delivering net zero emissions. So why is hydrogen touted as the key to Britain’s green recovery?

A recent report from the UK All Parties Parliamentary Group of MPs and businesses might explain why. It puts a very positive spin on hydrogen, but neglects to mention any other low-carbon alternatives.

The sponsors were businesses with a vested interest in promoting hydrogen: domestic gas boiler providers, gas network operators and fossil fuel producers who know that for the foreseeable future, hydrogen will be fossil derived. But is the vested interest of business best for UK consumers?

Tom Baxter is Senior Lecturer in Chemical Engineering at the University of Aberdeen. This article was first published by The Conversation and is republished here with permission.

|

UK companies lobby hard for “national hydrogen strategy” “A cross-industry group of over 50 companies has welcomed calls from the UK’s Environmental Audit Committee (EAC) for the government to pave the way for the hydrogen industry,” according to a news report from Kallanish Energy. The group, called Hydrogen Strategy Now, has previously urged UK’s Chancellor of the Exchequer, Rishi Sunak, to lay the foundation for a “clear, strategic plan” to develop hydrogen technologies, Kallanish Energy notes. The companies, which include Equinor, Uniper, Bosh, Anglo American, Alstom, Vattenfall and Cadent, say they are ready to invest and unlock £1.5 billion in private investment in the UK. This would create around 100,000 jobs, while helping the country to decarbonize and increase its energy security. They say the government’s “lack of vision risks scuppering hydrogen progress.” Last June, the group proposed to hold an online roundtable with Sunak and other officials to discuss the opportunities of a UK-wide hydrogen economy. The call for a hydrogen strategy echoes a similar appeal made by a group called the UK Hydrogen Taskforce, about which Gas Transitions reported in May 2020. The two groups are not associated with each other, according to a spokesperson. They do have many of the same members, including Cadent, Northern Gas Networks, Storengy (ENGIE), Arup, ITM Power and BOC (Linde Group), but not all. In particular BP, Shell, BNP Paribas, Arval, BDB and Baxi are members of the UK Hydrogen Taskforce, but not Hydrogen Strategy Now. Conversely, companies like Vattenfall, Alstom, Siemens, Bosch, EDF, Equinor, Orsted, RWE and Uniper are members of Hydrogen Strategy Now but not of the UK Hydrogen Taskforce. |

_f600x368_1599473245.JPG)