How Critical is Shipping to the LNG Value Chain?

But surely there are enough ships in the world? Oil fields are developed by and large without any requirement for dedicated shipping to transport their product to market. Instead, ship owners are happy to invest in tonnage and make this available for both short- and long-term charter, resulting in a deep and liquid tanker market. The vessels themselves are largely standardized, and the price of oil is largely inelastic to tanker charter rates. Disruptions in the oil value chain due to transportation constraints are exceptionally rare, except in the case of armed conflict or political strife.

The world of LNG shipping has, however, traditionally behaved very differently, for a number of reasons. Chief among these is the greater capital cost of the ships; for oil, very large crude carriers have typically cost $90–100 million to build, versus $180- 230 million for an LNG ship. As with the LNG production and receiving terminals, the high capital cost of the ships has necessitated dedicated project financing. All parties seek clear allocation of risk along the whole value chain, from upstream wellhead to end user burner tip—the whole commercial chain being known as the ‘cashflow waterfall.’ This has resulted in a dedicated physical supply chain servicing each LNG production facility, to either a single or small number of dedicated customers. The final investment decision for any upstream LNG project is not made until certified upstream reserves, production plant construction contracts, shipping charter parties, and gas sales contracts are all in place. And this tends to lead to vessels designed to trade to a narrow range of ports, operating under very long-term (20-year) charter parties.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

The LNG industry will always require large sums of capital for investment in production, supply, and customer facilities, so an underpinning from a proportion of dedicated long-term contracts will probably always be required. But as we see elsewhere in this issue, there is now a growing short-term LNG cargo market. Hence demand for shipping contracted on a short-term basis is now also strong, and growing; many industry players wish to move LNG but without long-term commitment to tonnage.

This began most significantly when ships built in the late 1970s and early 1980s reached the end of their long-term charters. The production plants they served were still producing, but often at lower rates as reserves began to decline. Some of these ships then became available for short-term charter. At the same time, some gas markets, notably in Europe and the United States, began to liberalize, and LNG producers sought to monetize excess production not lifted by their long-term customers. Integrated majors such as BP and BG (now part of Shell) sought to construct trading ‘webs’ of supply and demand points, with flexibility to move cargoes to whatever location resulted in the highest overall value. Both older ‘off charter’ ships and new ships ordered without dedicated trading routes formed critical transportation elements.

So a more useful question today might be, ‘How critical is dedicated long-term shipping to the LNG value chain?’—or better still, ‘Can I rely on the spot market to move my cargoes? Has the shipping world responded to this change in demand?’ The answer to these questions is probably ‘Yes, but it depends.’ Let us examine what is required for the development of a reliable short-term shipping market, what is actually in place today, and how this might change in the near future.

Vessel supply

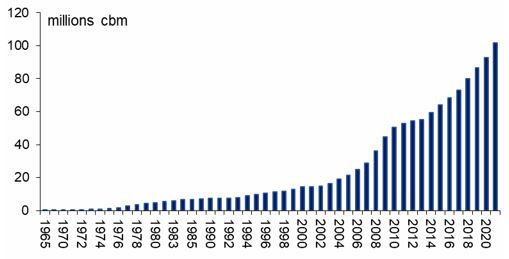

The capacity of the world LNG fleet is growing almost exponentially. Not only have vessel numbers increased, but the average size of new ships has increased from about 128,000 cubic metres in 2000 to about 175,000 cubic metres today.

Global fleet capacity

However, of the current approximately 600-vessel world LNG carrier fleet, only around 15 per cent of vessels are made available for short- or medium-term hire with any real frequency. And, considering the most modern and efficient vessels in terms of fuel and cargo capacity, this starts to become more select: so far this year only around 15 of the more fuel-efficient (MEGI/XDF) ships have appeared on the short-term market.

The makeup of the order book, however, is very significant. Of the 120 larger conventional vessels currently under construction, 45 do not yet have a charter secured. Independent owners—especially the more entrepreneurial European owners—are increasingly happy to place vessel orders first and search for charters later. Whether this shows faith in the fundamentals of the industry to deliver long-term charters, or in the growing spot market, is of course open to debate. Overall, however, we can see increasing numbers of vessels being made available for short-term hire.

Charter rate volatility

Vessels on the short/medium-term market fall into three main categories:

- older vessels where their original long-term charter has expired

- ‘portfolio’ ships that are usually engaged within a liner route or trading web business for a single charterer, but have some short-term time available

- more modern vessels reserved by their owners for the short/medium-term market.

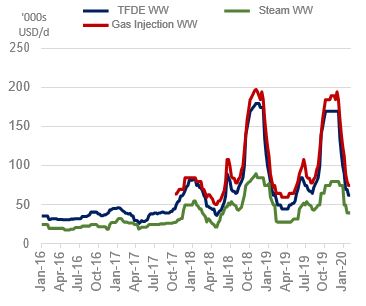

It is common in the tanker trade for owners to invest in new tonnage and reserve this for the spot (short-term) charter market. Owners have confidence that this market will be sufficiently liquid to enable them to keep their vessels employed most or all of the time. The charter rates they achieve will vary, but charter rate risk is at the heart of their business and they are skilled at making the timing judgements required to take best advantage of volatility. Volatility is precisely what draws them to the market. And recent short-term time-charter rates for LNG ships have seen similar volatility. Short-term rates for modern vessels have varied between the high $20,000s and about $180,000/day. But can owners be reasonably sure of employment for their vessels in this short-term market? Even though the vessel investment picture is improving it is becoming rarer for modern tonnage to remain without charter business for more than a few weeks.

Short-term charter rates for LNG ships

Still rare in the LNG market are sales of second-hand vessels, especially of more modern tonnage. Such sales are common in other shipping sectors, and ‘asset plays’—buying tonnage at times of low prices in the hope of selling later in inflated markets— form the mainstay of many ship owners’ business strategies. It would take a bold owner, however, to make this the heart of a strategy for investment in relatively expensive LNG vessels. This has a knock-on effect on how LNG vessels are financed; as so few resales are made, there is little data on which to base assessments of potential future resale values. This inability to assess ‘residual value risk’ is difficult for lending banks, which are wary of taking even implied risks on ship values. Hence, LNG shipping is the territory of borrowers with a strong track record of honouring shipping loans. As resales become more common, this will enable more confident appraisal of residual value risk, and hence more liquid lending to a wider range of new-entrant LNG vessel owners.

To summarize, there is certainly demand for short-term LNG vessels, and supply is doing its best to catch up. For a truly deep and liquid market, however, further factors must be considered, principally standardization, information flow, and maintenance of safety standards.

Standardization

There are currently around 34 active LNG load ports and 134 discharge ports. So a ship built to fit in just one of each will not be much use in a short-term market. And yet traditionally LNG ships were built for very specific routes, usually from one load port to a limited range of discharge ports. In a world of flexible short-term ‘tramp’ shipping, vessels need to be compatible with a wide range of ports. Such standardization is essential not only for the ships themselves; ports need to be agile in their acceptance procedures for ships, and charterers need to be clear and reasonable with owners with regard to their ship vetting procedures. As ever, the LNG world can learn from the tanker trade, where vessel and port standardization, port control, and vetting processes—such as the OCIMF SIRE (Oil Companies International Marine Forum/Ship Inspection Report Programme) system, and TMSA (Transportation Marketing and Sales Association) management self-assessment—are nimble enough to facilitate the rapid contracting required to meet short-term vessel requirements. The contracting terms themselves are, of course, equally important: rapid contracting depends on well-understood, fair, and balanced charter parties. The development of contracts such as ShellLNGTime is to be most welcomed.

Flow of information

Any efficient market depends on the flow of information—cargo requirements, vessel availability, data on vessel–port compatibility, and the satisfaction of vetting and regulatory requirements. Some such information—for example, terminal compatibility requirements—can and should be shared more openly than the LNG industry is used to doing.

In a sector where the number of owners and charterers is growing exponentially, however, merely bringing the two parties together becomes more and more important. Traditionally, this is the role taken by ship brokers, who facilitate transactions, share important but more confidential information in a more sensitive fashion, and work to prevent or if necessary mediate disputes. Relationships, as always, still matter.

Safety

The LNG shipping industry boasts a proud safety record maintained over many years. Since the first industry cargo in 1964 there has not been a single major accident attributable to the cargo itself. Arguably the historic liner-trade nature of the business, and common cost pass-through maintenance regimes, have enabled this focus on safety and reliability. But the nature of the trade is changing; and in the tanker world, any major incident could have severe ramifications for the industry. Agile but robust ship inspection and vetting processes must be maintained. Ultimately, safety on board is the ship owners’ responsibility, despite the pressures on crewing and maintenance costs that arise in inevitable short-term charter market downturns. However, it is in all industry players’ interests both to ensure that the shipping market delivers returns over the long term that allow responsible owners to crew and maintain their ships safely and reliably, and not to tolerate those who do not consistently achieve such standards.

Conclusions

At a rather obvious level, without shipping there is no LNG value chain. Growth in the short-term and spot LNG cargo market will always be constrained without corresponding expansion of the short-term LNG shipping market. The size of the world LNG ship fleet is growing at an unprecedented level—but will the LNG shipping world take the best lessons from other trades and promote short-term liquidity, whilst maintaining its hard-earned reputation for safety and reliability? The quality and number of new entrants into this market would suggest a resounding ‘yes’.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.