Hoegh LNG Profits Up, Eyes 2018 Ghana Launch

Shipowner Hoegh LNG reported stronger 1Q results May 24 and said its Ghana floating regas project is ‘on schedule’.

Net 1Q profit was $11.45mn, almost double its $6.3mn profit in 1Q 2016.

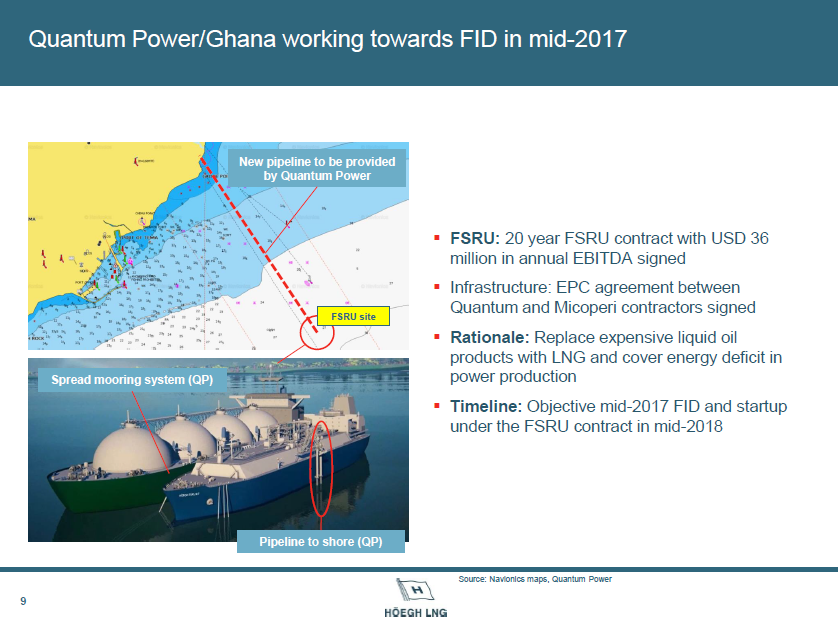

In Ghana, the Quantum Power floating regas project “continues to make progress and is working towards the mid-2018 start-up,” said Hoegh. Five months ago it signed a 20-year charter of a FSRU (floating storage and regasification unit) to the venture which it expects to yield $36mn/yr on an Ebitda basis. But the project has yet to take a final investment decision, which Hoegh LNG expects in mid-2017. Last month on April 27 it took delivery of Hoegh Giant FSRU, which is has earmarked for Ghana and which, starting June 2017, has been chartered out on a short-term basis to an LNG trader.

Ghana was to have been sub-Saharan Africa's first LNG importer but things there have not worked out to plan: rival shipowner Golar's Golar Tundra FSRU unit remains in limbo, anchored offshore Ghana now for almost a year, most of which was spent awaiting approvals.

Ghana slide from Hoegh LNG's May 24 2017 presentation (Graphic credit: the company)

In Chile meanwhile, Hoegh said the Penco FSRU project has been delayed by 12-18 months but that it remains “fully committed” to the project which is “progressing towards a final investment decision.”

All six existing FSRUs and two LNG carriers in Höegh LNG’s fleet operated in accordance with contracts during 1Q 2017, it said, with their technical availability stable at close to 100%.

Also during 1Q, Hoegh announced signing of a FSRU newbuilding contract with South Korea’s Hyundai Heavy Industries (HHI) for 4Q 2018 delivery; it also joined a consortium with LNG producers to provide a floating storage and regasification unit (FSRU) for the GEIL project in Pakistan which Hoegh now says is “making progress towards its final investment decision.”

Höegh LNG now has three FSRUs under construction at HHI and Samsung Heavy Industries in South Korea, and these newbuildings have scheduled delivery dates in 1Q and 4Q of 2018, and 2Q2019; only one of the three is uncommitted.

Global LNG market of 75mn mt in 1Q2017, says Hoegh

Looking at the global market, LNG demand rose by 13% year on year to 75mn mt in 1Q2017 with biggest increments from Japan, South Korea, China, Turkey, Pakistan, Thailand and Portugal while Australia and the US were the two largest LNG supply growth drivers. Hoegh said it “continues to operate in a positive market environment as LNG volumes expand, keeping gas prices at very competitive levels and triggering interest in new and existing regions for installing FSRUs to import LNG.”

Mark Smedley