Higher investment is needed for Eagle Ford to facilitate growth

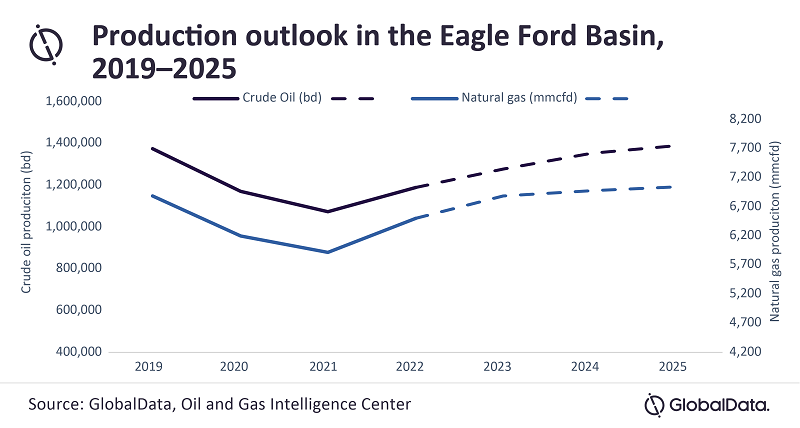

Crude oil and natural gas production in the Eagle Ford shale play, situated in southeast Texas, dropped by almost 35% and 20%, respectively, in May 2020 due to the COVID-19 pandemic, according to GlobalData. The leading data and analytics company notes that, despite a recent sustained upswing in WTI crude oil prices, with prices hovering over US$70 per barrel, production of both crude oil and natural gas is failing to show signs of a major increase. In order to reverse the production trend, it is estimated that an additional US$1.5 billion of investment is required to increase production by 10% by the end of next year.

According to GlobalData’s latest report, ‘Eagle Ford Shale in the United States of America (USA) – Oil and Gas Shale Market Analysis and Outlook to 2025’, production in the Eagle Ford has been somewhat stable at 1,070 thousand barrels per day (mbd) for crude oil and 5,850 million cubic feet per day (mmcfd) for natural gas since June last year.

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

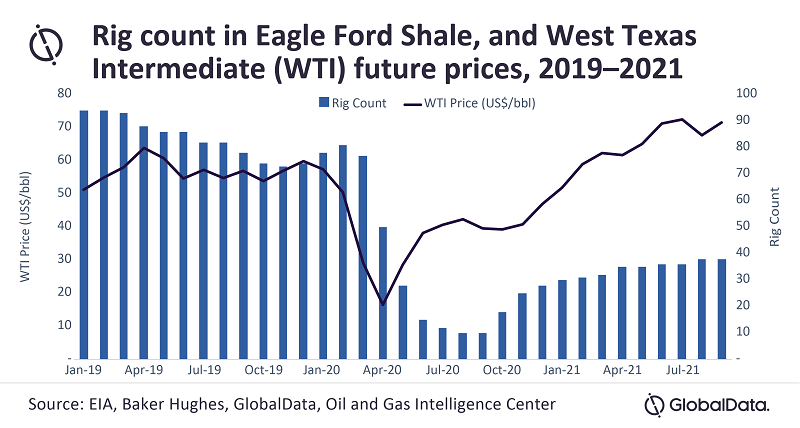

Svetlana Doh, Oil & Gas Analyst at GlobalData, comments: “As WTI futures prices climbed up by 38% in the first half of 2021, and reached $72 per barrel of oil in July, there has been an increase in drilling activity in the Eagle Ford where rig count rose by 27%. However, we are yet to see an increase in production as newly drilled wells need to be completed and put on production. The speed at which rigs are added slowed at around 3% in the past six months, which suggests that production is not likely to rebound to pre-pandemic levels of 1,400 mbd in the next two years, unless Eagle Ford operators chose a more aggressive drilling strategy.”

Doh continues: “Similar to other basins, the Eagle Ford also saw an increase in merger and acquisition (M&A) activity as operators attempted to consolidate their focus on core positions. For example, SilverBow Resources has its primary position in the Eagle Ford shale and is currently in the process of completing its third acquisition deal within the play. The series of deals are aimed at strengthening the company’s position in the play by having a larger number of high return locations, as well as giving the operator more flexibility in building its future development strategy.”

While there seems to be more interest in the Eagle Ford shale as prices are up, the Permian Basin is still the major player for Texas and will see the majority of operators’ active rigs for the near future. The Permian Basin rebounded to pre-pandemic production levels last month, despite the fact that the basin experienced the biggest production drop among any other play in the US last year.

Doh concludes: “Assuming oil price remains stable at current levels, crude oil and natural gas production in the Eagle Ford shale is projected to jump on an upward trend throughout the forecast period of 2021-25. Natural gas production in the Eagle Ford shale is expected to grow by 17% during 2021-25 and reach 7,000 mmcfd in 2025, while crude oil production in this shale is expected grow by 29% to 1,400 mbd. Therefore, both commodities are expected to exceed their 2021 levels of production by the end of 2024.”

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.