Electricity Has Biggest Share of Energy Spend: IEA

The electricity sector attracted the largest share of energy investments in 2017, sustained by robust spending on grids, exceeding the oil and gas industry for the second year in row.

That is one of the conclusions from the International Energy Agency’s World Energy Investment 2018 report, which found that global energy investment totalled $1.8 trillion in 2017, a 2% decline in real terms year on year. The total equated to about 2% of global GDP, the IEA added.

More than $750bn went to the electricity sector, down 5%, while $715bn was spent on oil and gas supply globally, up 2%.

The share of global energy investment driven by state-owned enterprises (SOEs) increased over the past five years to over 40% in 2017; many have been more resilient upstream, and in thermal power generation, than private actors. Meanwhile, government policies are playing a growing role in driving private spending, the WEI 2018 report also found.

After several years of growth, global investment in renewables and energy efficiency declined by 3% in 2017, the report found, with a risk it could slow further this year as China slows its solar spending. IEA executive director Fatih Birol (pictured above) said the trend was worrying as “this could threaten the expansion of clean energy needed to meet energy security, climate and clean-air goals.”

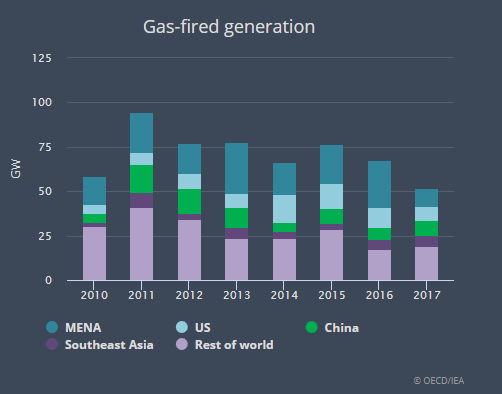

Gas-fired power plant investment, measured by final investment decisions in gigawatts, also declined in 2017 by 23%. This sector had been led for a long while by expansion in the US and North Africa, but even in those regions it declined last year (see IEA graphic below). Retirements of nuclear power plants exceeded new construction starts, and hydro investment also declined.

In a boost for low and no carbon generation, the report found that final investment decisions (FIDs) for coal-fired power plants to be built in the coming years declined for a second straight year, reaching a third of their 2010 level. Despite this, however, the global coal fleet continued to expand in 2017, mostly in Asia – with three in every five plants using “inefficient subcritical technology.”

US shale at turning-point

Prospects for the US shale industry are improving, WEI 2018 proclaimed, almost halving its breakeven price and providing a more sustainable basis for future expansion – and recording a record increase in US light tight oil production of 1.3mn b/d in 2018.

“The US shale industry is at turning-point after a long period of operating on a fragile financial basis and appears on track to achieve positive free cash flow for the first time ever this year,” said Birol.

The report can be accessed via http://www.iea.org/wei2018/