Liquefied natural gas: US hype and German obedience? [GGP]

The US has a vested interest in selling liquefied natural gas to Europe's biggest economy as it produces a lot more than it needs at home. But is LNG really vital for Germany's long-term energy strategy?

What's the difference between LNG and conventional natural gas sent through pipelines?

|

Advertisement: The National Gas Company of Trinidad and Tobago Limited (NGC) NGC’s HSSE strategy is reflective and supportive of the organisational vision to become a leader in the global energy business. |

Liquefied natural gas (LNG) is just as odorless, noncorrosive and nontoxic as ordinary natural gas. The only difference is that LNG is natural gas cooled to roughly minus 260 degrees Fahrenheit (minus 190 degrees Celsius).

This is done to shrink its volume by around 600 times, which makes the resource — now a liquid — a lot easier to store and transport on huge tankers. Cooled down so much, it has an additional useful property: It's no longer explosive or flammable.

Who are the largest natural gas producers?

The United States is now the world's leading natural gas producer. Not least owing to extensive shale gas fracking, the country boasts an abundant supply that is not just big enough to power the US itself for many decades or even centuries ahead; it also enables the country to export a growing amount of the valuable resource.

While the US is the biggest natural gas producer at 766,200 million cubic meters (27 trillion cubic feet) annually (end of 2017), Russia is a close second at 635,500 million cubic meters, followed by Iran and Qatar.

And who are the biggest LNG exporters?

As of December 2018, Australia has been the world's largest exporter of liquefied natural gas, relegating Qatar to second place, ahead of Malaysia in third position.

But the United States is aiming to be among the top three by the end of this year. It has been massively adding liquefaction capacity to profit from enhanced global natural gas demand. The country is expected to add over 6 billion cubic feet of daily liquefaction capacity by 2021.

That would come on top of the over 3 billion cubic feet per day stemming from the country's Sabine Pass and Cove Point facilities.

Will the EU need more natural gas in the future? Will Germany?

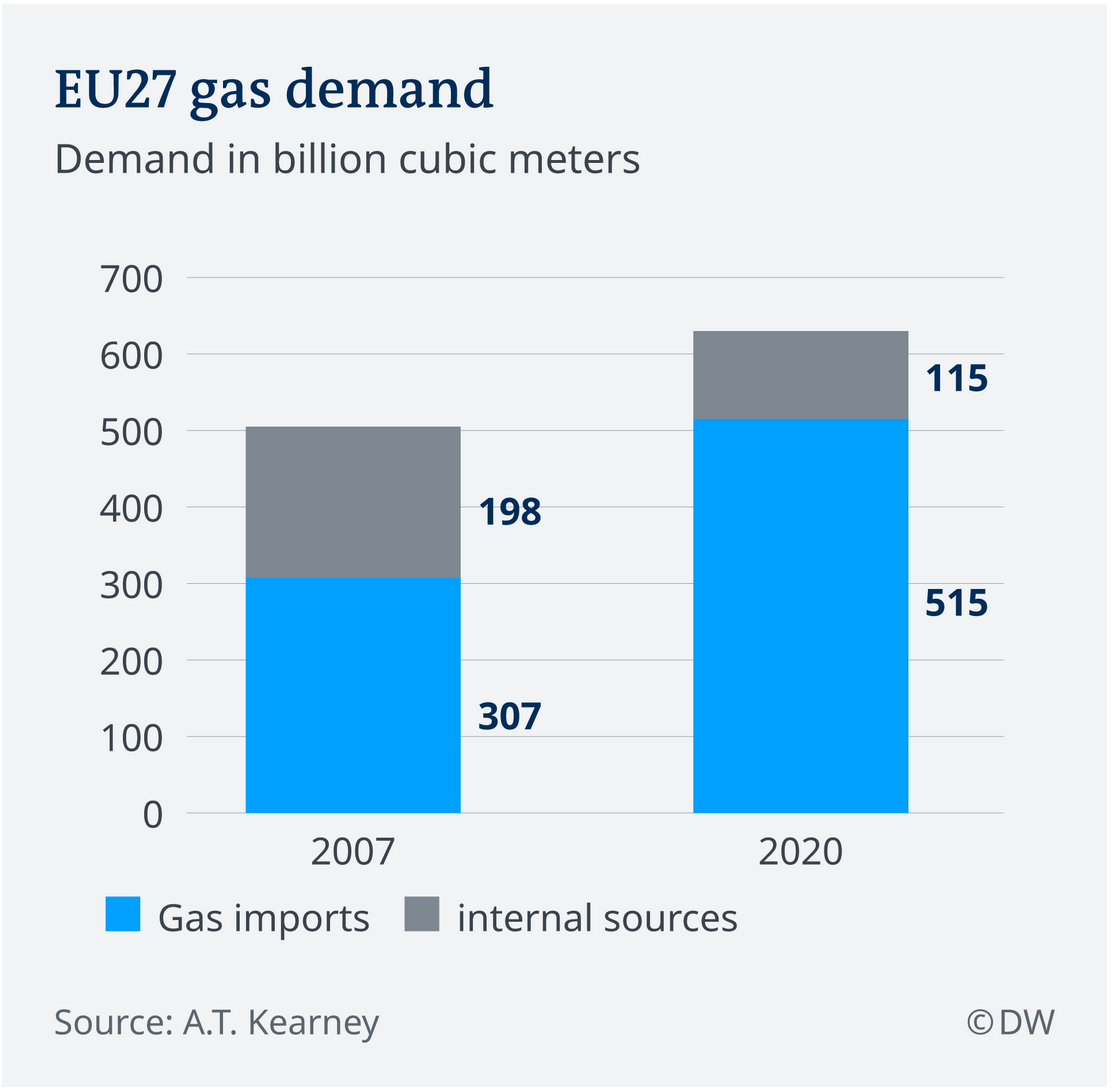

The answer is "yes" to both. Nations across the European Union value gas as a much cleaner alternative to other fossil fuels. And they cannot rely for much longer on a steady supply from within the bloc.

Norway's resources are depleting, and the Netherlands has already announced it will reduce gas supplies by two-thirds as of 2022 and halt them completely by 2030 because of unsafe extraction conditions.

Should the Russia-led Nord Stream 2 gas pipeline project go ahead as scheduled, Europe's dependence on Russia will no doubt increase, but relatively cheap gas supplies make the deal so enticing.

The US administration, just like Eastern European nations, have vociferously advised against the Nord Stream project, and Washington has pushed its very own solution to the conflict — making more EU nations, and above all Germany, buy LNG from the US.

Does Germany really need LNG at all, and LNG from the US specifically?

Europe as a whole has recently increased its LNG imports by 1.4 billion cubic meters per day. Among the main recipients have been Spain, Italy, Portugal and France.

It would be taking it too far to claim that those nations depend on LNG supplies, but they've seen it as a useful diversification of their energy sources. That certainly makes sense, given that the countries in question have the necessary infrastructure in place to receive LNG from tankers.

In the case of Germany, including direct LNG deliveries in its energy mix would also make sense in terms of diversification, but it wouldn't really need a lot more right now despite the country phasing out both nuclear and coal power, and it wouldn't necessarily need LNG from the United States.

Is Germany technically prepared to receive liquefied natural gas?

Unlike EU nations such as Belgium and the Netherlands, Germany doesn't have its own terminal to import liquefied natural gas directly.

But at a German-US conference on energy security in Berlin on Tuesday, German Economy Minister Peter Altmaier strongly supported the construction of at least two such terminals in northern Germany. Brunsbüttel, Stade or Wilhelmshaven were mentioned as likely locations.

US Deputy Energy Secretary Dan Brouillette said at the meeting his country was currently exporting LNG to 10 European nations, adding he was confident that Germany would join the group.

"The question is not if, but when," he said, noting that lesser dependence on Russia was crucial.

Article originally published by DW. Please visit DW for related video.

The statements, opinions and data contained in the content published in Global Gas Perspectives are solely those of the individual authors and contributors and not of the publisher and the editor(s) of Natural Gas World.