Germany: long-term or transient LNG market? [Gas in Transition]

Just because a country turns to LNG today, does not necessarily mean it will use it tomorrow. Egypt and Israel are prime examples of countries which brought in floating regasification and storage units (FSRUs) to ensure stable gas supplies, only to make significant offshore gas discoveries and later turn to exports, either pipeline, or, in Egypt’s case, both pipeline and LNG.

Mexico has seen its LNG imports plummet not because of an increase in domestic gas production, but because of an influx of imported shale gas from the US. Such is the inflow that Mexico itself expects in coming years to also turn LNG exporter. Argentina’s LNG demand has ebbed and flowed with the level of domestic consumption and the success of its domestic gas production, which still promises a future as an LNG exporter rather than importer.

Net zero deadline

Germany’s prospects as a long-term LNG market are more complex. Its net zero by 2050 policy and antipathy towards Carbon Capture Utilisation and Storage as a climate change mitigation solution both appear to put a firm end-date on its use of natural gas, whether sourced by pipeline or LNG.

The longevity and decline trajectory of gas demand – steady reduction or large-scale use followed by rapid post-2040 reduction or earlier -- are tied to the success of the energy transition, not just within Germany, but externally, for example in terms of the growth and availability of low carbon hydrogen as an internationally-traded fuel.

The crisis in Ukraine and the apparent ending of the Russia-Europe energy relationship demonstrate that critical events can take precedence over the fight against climate change. However, the growth of renewables and electrification provide solutions to both through the achievement of a much greater degree of domestic electricity generation and energy independence.

If the technological problems facing hard-to-abate sectors of the economy prove readily resolvable, and external security conditions allow, the energy transition could accelerate faster than expected and gas and LNG demand decline quicker.

What path will LNG demand in Germany take?

Structural factors

There are good reasons to believe Germany’s use of LNG will be prolonged throughout the 2023-2050 transition period.

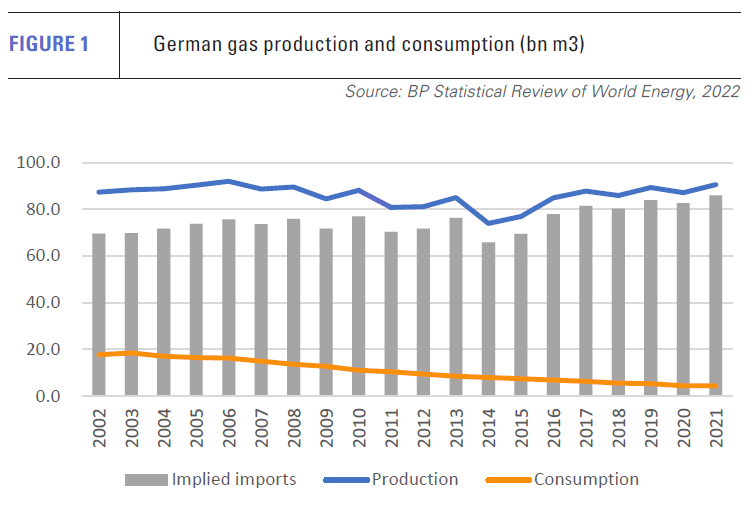

There is little likelihood of major new domestic gas discoveries. Domestic gas production, which has never been large, is in long-term decline and already at low levels – just 4.5bn m3 in 2021, about 5% of total consumption (see figure 1). Even if gas use appears to have peaked, imports have been on a steady upward trend since 2013.

A return to dependence on Russian gas looks highly unlikely, even in the event of regime change in Moscow. If Germany wants natural gas, LNG thus looks like the best and probably only practical option, given Germany’s physical distance from gas-rich parts of the world bar Norway.

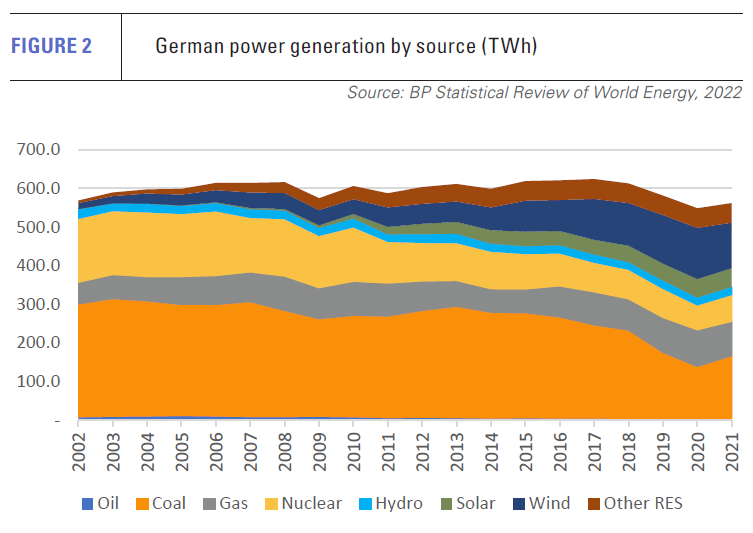

In addition, Germany’s coal phase out plans have been delayed by the Ukraine crisis and are a lot slower than the rest of Europe. It remains committed to phasing coal out, if over many years, as well as closing its remaining nuclear plants. As a result, coal-to-gas switching in power generation remains an option for greenhouse gas emissions reductions and does so on a more substantial basis than other European countries, including coal-dependent Poland.

Coal-fired generation capacity has fallen from 45.5 GW in 2011 to 37.9 GW in 2022, while nuclear capacity dropped from 12.1 GW to 4.1 GW. The loss of this capacity has been made up predominantly by renewables, but gas-fired generation capacity has crept up from 27.2 GW to 32.3 GW over the same period (see figure 2).

Finally, Germany’s gas use is not centred on power generation (see figure 3). Residential, services and agricultural gas use made up 46% of consumption in 2021, followed by industry at 27%, while power generation accounted for just 17%. In the household sector, 90% of gas use is for heating. Heating and industry are hard-to-abate, and their displacement by renewables and electrification are likely to take longer than in other areas.

On the other side of the equation, plug-in electric vehicles in Germany accounted for a huge 55% share of new passenger car sales in December, while the full year result was 823,000 new registrations or 31% of the new passenger car market. The December figures were likely inflated by an end of year rush to benefit from incentive schemes, but the overall trajectory suggests Germany is on course for the passenger car market to become fully electric ahead of the EU’s 2035 100% zero emissions vehicles target.

The aspect to note for the LNG market is that this rapid transition in the passenger car market, alongside electrification in the household heat and industrial sectors, are likely to underpin stable or growing electricity demand, offsetting efficiency improvements.

Crisis averted

Although it has come at some cost, Germany has averted a gas crisis as a result of importing more gas from its neighbours, much of which landed as LNG. Demand conservation, a lack of severe cold weather, increased coal generation and more renewables have all played a part.

It has also achieved an extraordinarily rapid deployment of FSRUs, enabled by the LNG Acceleration Act, passed soon after Russia’s invasion of Ukraine. From the first quarter of this year, this will allow the country to secure substantial LNG volumes directly.

In early February, German storage operators group INES was able to announce that there was now no chance of a gas shortage this year, although refilling stocks for next winter will require LNG imports to continue at high levels.

There is little question about that. In January, Russian state gas company Gazprom’s gas flows to Europe totalled only 1.7bn m3, a record low level and 29% down on December. Exports through the two remaining import routes – Ukraine and TurkStream – were both down.

At the same time, Russia has initiated a new offensive in Ukraine, indicating that Moscow has not given up on its maximalist military goals.

Europe has this year to cope with a full 12-months of sharply-reduced Russian gas pipeline imports, rather than the less than 10 months experienced in 2022, when Russian gas exports to Europe via pipeline has already fallen to a post-Soviet low.

FSRUs – a flexible option

Germany’s FSRU deployments will be essential to rebuilding gas stocks this year and surviving next winter.

The country’s first LNG cargo arrived on January 3 at Uniper’s new Wilhelmshaven import terminal, where the Hoegh Esperanza has been deployed. The historic LNG delivery came from the Calcasieu LNG plant in the US aboard the LNG Carrier Maria Energy.

The terminal has a regasification capacity of 5bn m3/yr. First LNG was fed into the German grid on December 21, from the commissioning cargo onboard the FSRU. A second FSRU is expected at the terminal in the fourth quarter of this year, doubling overall capacity.

On January 13, TotalEnergies announced that the Deutsche Ostsee LNG terminal near Lubmin on Germany’s Baltic Sea coast had started operations. The terminal is using the FSRU Neptune, which will be operated by Deutsche ReGas. The vessel can also regasify up to 5bn m3/yr.

Deutsche Regas plans a second FSRU at the Lubmin terminal. In addition, RWE and Stena Power are reportedly considering a further vessel sited at the port.

Meanwhile, the 170,000 m3 Hoegh Gannet arrived at Brunsbuettel on January 20, where it started the commissioning phase of RWE’s Elbehafen LNG import terminal.

The FRSU arrived carrying a partial cargo loaded at Spain’s Mugardos LNG terminal. Commercial operation was slated to begin in the second half of February. After commissioning, LNG supply will come from the UAE. The terminal has a capacity of 5bn m3/yr.

In total, Germany will have put in place 15bn m3/yr of LNG import capacity in the space of less than a year with more to be deployed this year.

Flexibility and commitment

FSRUs have been used because they could be delivered fast. They represent an emergency response rather than a long-term commitment. They are flexible assets which can be redeployed, if demand for imported LNG falls. There have also been analyses suggesting that Germany may be overcommitting to LNG import capacity, when other import options and demand conservation and destruction, as a result of switching away from gas, are taken into account.

Significantly, no final investment decisions have been taken on onshore LNG terminals, which would represent a more enduring investment, but there are plans.

The Hoegh Gannet is expected to be replaced at Brunsbuettel by a permanent onshore terminal by 2026. The Stade LNG project originally anticipated an onshore LNG facility, but this has changed so that the terminal will host, at least initially, an FSRU. The group behind the project, Hanseatic Energy Hub, wants to construct an onshore terminal with capacity of 13.3bn m3 by 2026.

HEH includes the Buss Group, infrastructure operator Fluxys, Partners Group and US chemicals company Dow. The Stade FSRU is expected to start operating from the end of this year.

Nonetheless, the lack of firm plans for onshore terminals suggests German policy makers and developers are biding their time in a highly uncertain geopolitical and domestic policy environment. The net zero background means German ambivalence towards LNG, which in theory at least would not be needed in a post-energy transition world, is strong and will strengthen, if the current crisis loses its intensity and other options look increasingly viable.

FSRU deployment has been accompanied by plans to see some of the LNG import infrastructure repurposed to import hydrogen, but this remains a speculative option, given the lack of green hydrogen production – which German policy heavily prefers – the costs of producing it and the limited end-user capacity to consume it.

As a result, given the country’s still high dependence on coal, aversion to nuclear power and desire to electrify significant parts of the economy as a primary decarbonisation route, LNG looks likely to play a critical role in the country’s gas supply over the next decade and probably longer. But post-2040, the outlook starts to dim significantly.

LNG probably has a 20-25 year role in what is the world’s fourth largest economy, before hitting the buffers. German LNG demand cannot be described as transient, but neither is it truly long term.