Gazprom’s Flows to Europe Down in April

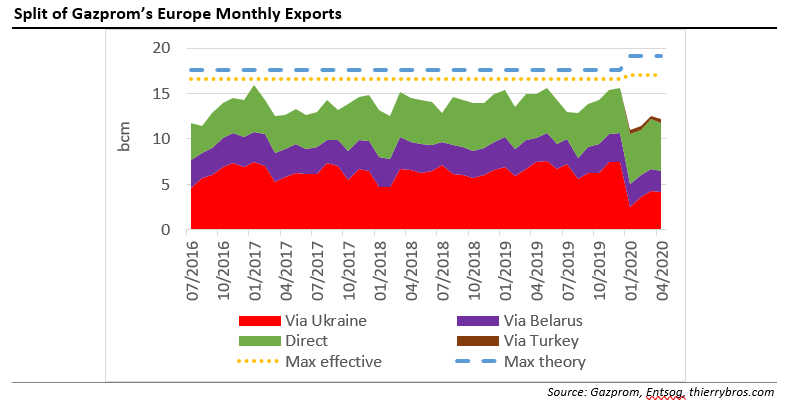

The December 29 transit deal between Gazprom and Naftogaz provides for 65bn m³ transit volumes for 2020. As the 65bn m³ should be on a uniform flow of 178mn m³/d[1] or 5.5bn m³ /month, any lower flow in one month cannot be offset by higher flow in a later month. With lower contracted transit flows, this means that the maximum contracted volume via Ukraine could now only be 58bn m³ for 2020.

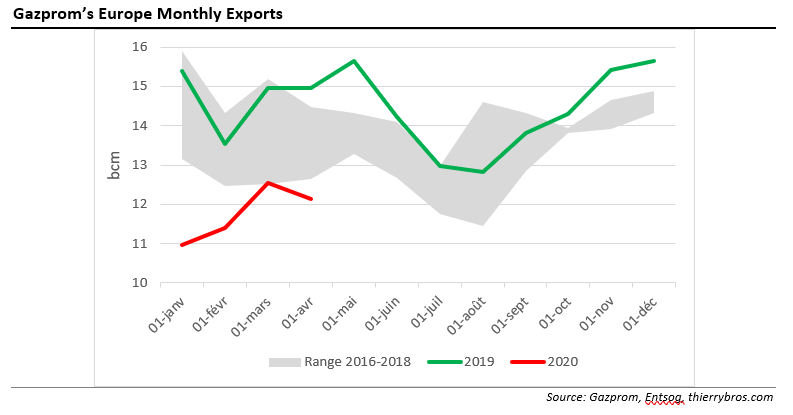

Gazprom’s flows were in April 2020 again down massively both compared with last year (-18.8%) and with last month (-3.2%). The coronavirus-impacted-demand will continue to restrain EU imports needs.

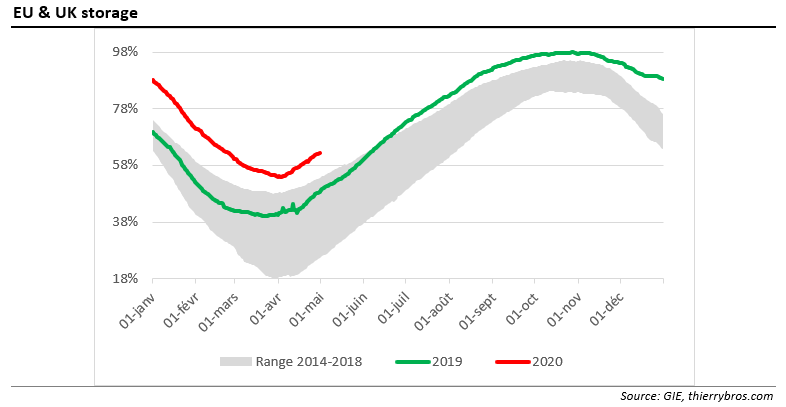

With the Covid-19 demand destruction, storage is filling even faster than last year. Since the 54% minimum reached on 2 April, storage level has increased to 62.5%, a 1.1 percentage point more than last year during the same period.

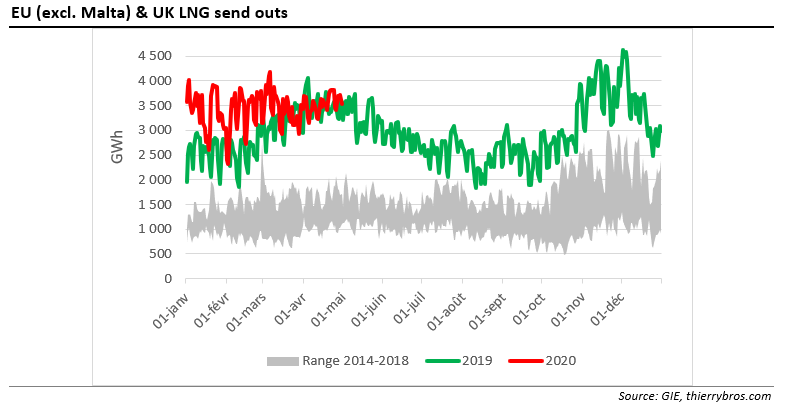

As we have been writing since early this year and contrary to consensus, Gazprom is not the only producer to swing supply any longer. For the first time ever, Gazprom may only hold half of the global spare capacity. All producers are sharing the burden of reducing volumes to the EU and this translates also in less pipe gas and LNG imports.

The existing long-term gas transit contract between Russia and Poland for the use of the Yamal-Europe (33bn m³/yr capacity) expires May 18. So, we will need to watch out this month if the contract is renewed and, if not, how this translates in flows redistribution away from Belarus (which accounts for 2.7bn m³ /month on average). And before May 24, we expect the German regulatory authority Bundesnetzagentur decision on whether or not to grant Nord Stream 2 a derogation… Stay tuned!

[1] https://interfax.com.ua/news/interview/635485.html

Thierry Bros

May 6, 2020

Advisory Board Member Natural Gas World