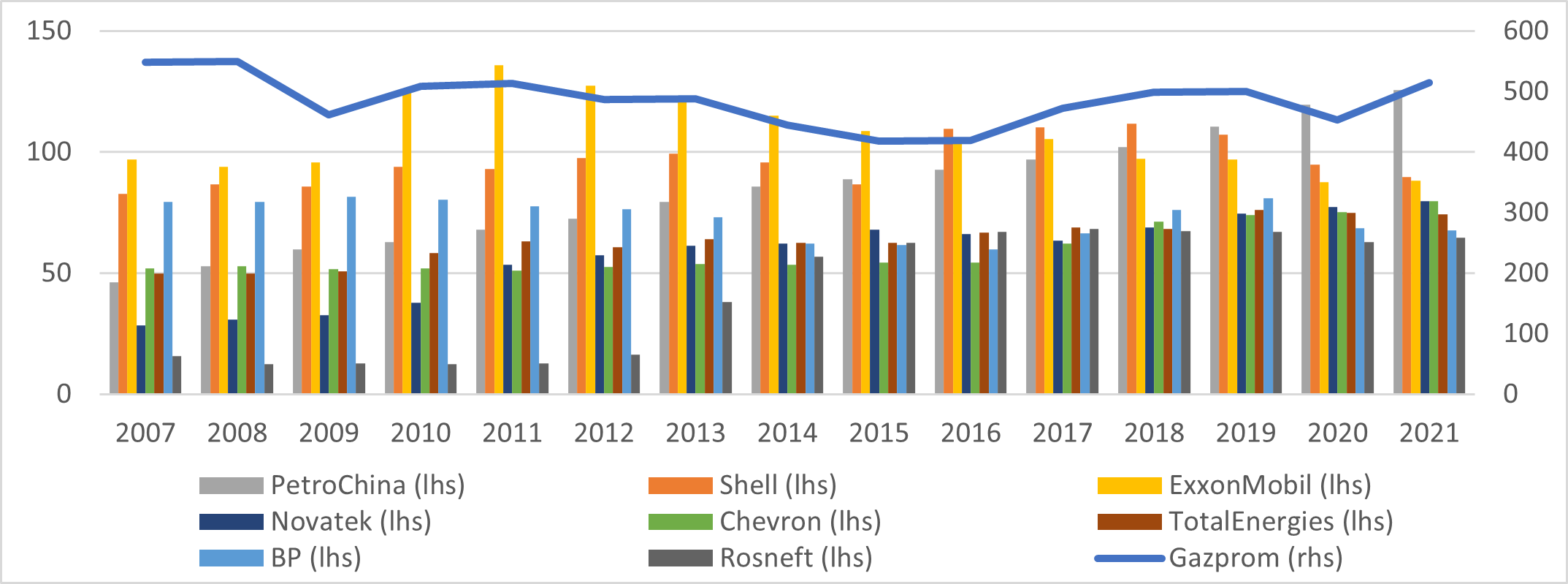

Gazprom undisputed top gas producer in 2021

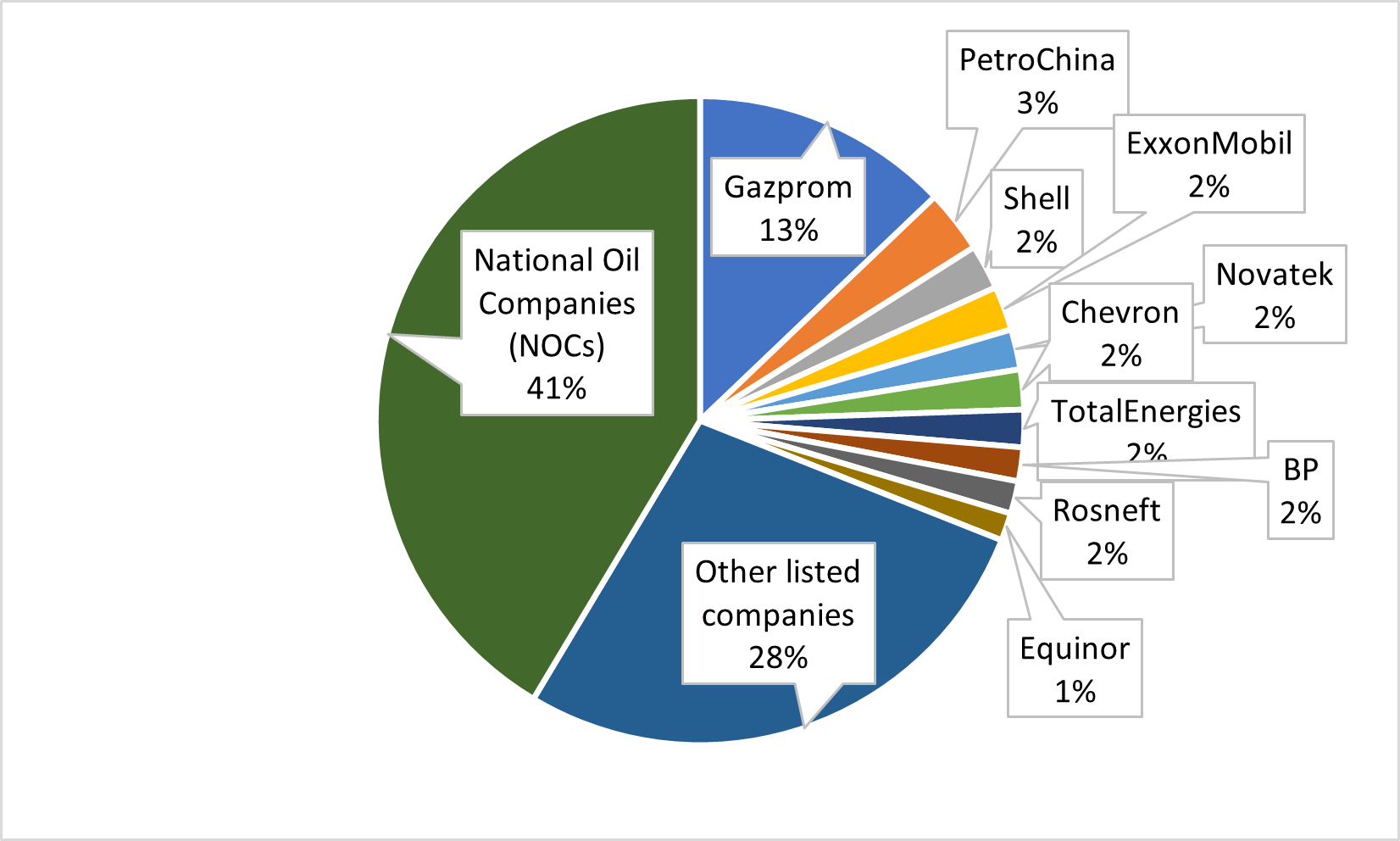

As major listed gas companies have all published their financial results for 2021 [1], it is now possible to compare their levels of gas production [2]. Gazprom remains the undisputed top producer, with a 13% share of the global market, followed once again by PetroChina. Four partly state-owned Russian and Chinese companies control 19% of global gas supply, which should be another wakeup call at a time when Europe is working to reduce its dependency on Russian commodities.

Natural field decline, lower capital expenditure since 2022 and unplanned downtime are making it more and more difficult for some companies to effectively expand their gas production. But Gazprom, Chevron and Equinor all managed to increase it substantially [3], by 13.8%, 5.7% and 5.1% respectively in 2021, while other European international oil companies (IOCs) saw continued production decline. After the International Energy Agency (IEA) published its net-zero scenario last year, we have passed an inflexion point. European IOCs are pursuing greener, less profitable business, whereas national oil companies (NOCs) and American IOCs are set to benefit massively from less competition in the growing oil and gas market. That is unless the war in Ukraine changes the conventional energy thinking for good.

Evolution of top gas producers (2007-2021)

Source: company data, thierrybros.com

-

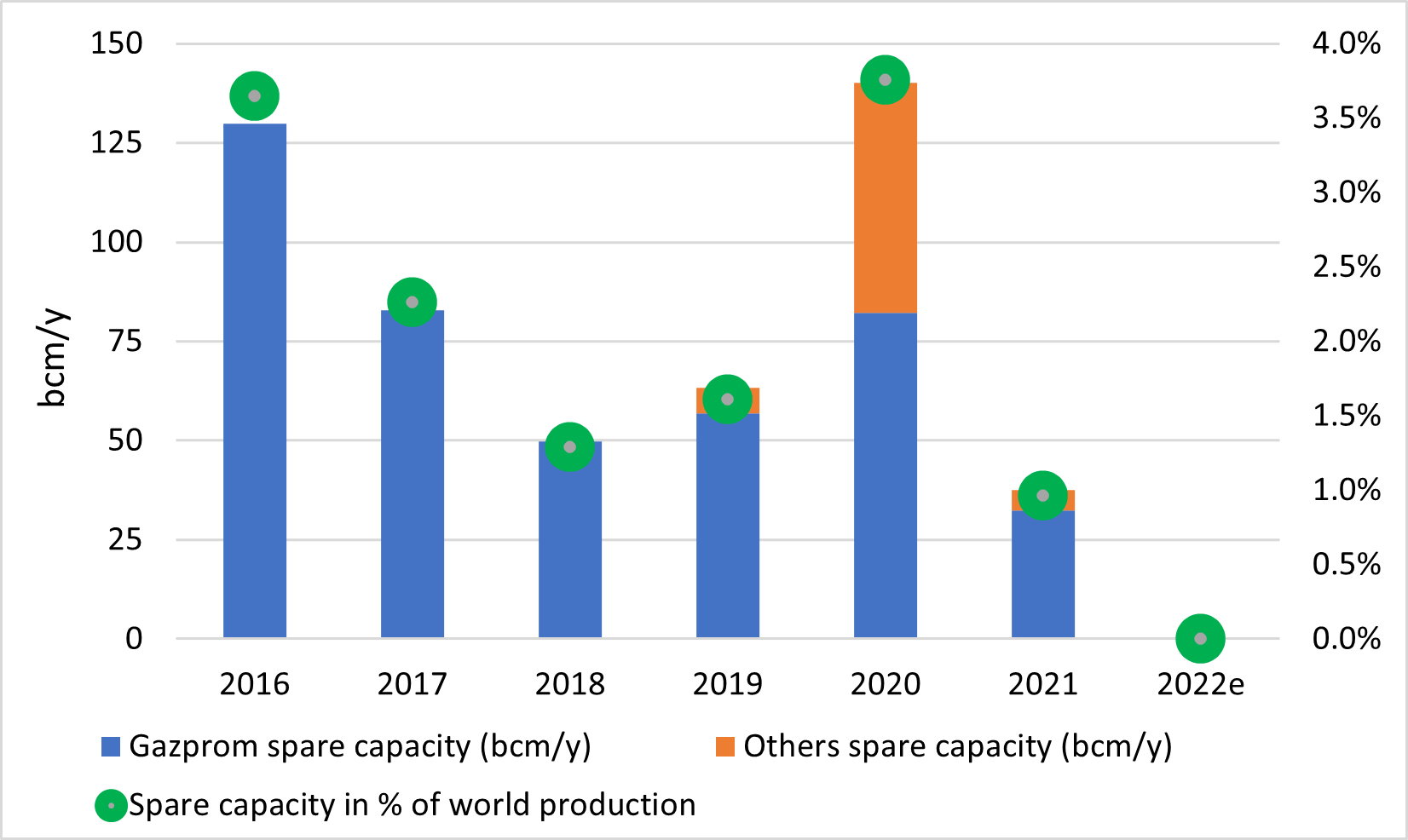

With a massive 13.8% growth in 2021, Gazprom stays the undisputed leader in gas production, and has also increased its share of global supply from 12 to 13%. This is its best production figure since 2008, and the growth has been at the expense of spare capacity. In Q4 2021, we can safely assume that Gazprom had no spare capacity. Gazprom’s estimated spare production capacity [4] was at best 32bn m3 on an annualised level in 2021. In fact, Gazprom production capacity has not increased in recent years with the new Far East programme supporting deliveries to China, which means that while production capacity increased East for China, reaching 10bn m3/yr, it decreased by the same amount West for Europe. This is why Gazprom wanted, prior to the war in Ukraine, to fast-track the production of the Kharasveyskoye field (32bn m3/yr in 2023). With the war in Ukraine, Western governments will try to reduce their significant dependence on Gazprom. If Western contracts are not renewed (the Polish contract was always expected to not be renewed after its expiry in December 2022), or in case of tougher sanctions, it is likely Gazprom will have to cut its production.

-

PetroChina, with its focus on gas over oil production growth, overtook ExxonMobil in 2018 and Shell in 2019, and is now firmly in second place. Its gas output was up 5% yr/yr in 2021, reaching its highest level in history, and the proportion of gas in oil and gas equivalent output continued to increase. With a 6.0% 2016-2021 organic CAGR, PetroChina is second to Chevron (+6.5%). PetroChina is intensifying its natural gas exploration and development, to support a rapid growth in gas consumption. Its oversea gas production continues to decline (-12.9% in 2021), accounting now for only 54.5% of its total production.

-

Shell witnessed the worst drop (-5.4%) in its gas production last year, mainly due to "supply issues" and its divestment from the Permian. Like BP, it is now splitting its gas production into two different business divisions (upstream and integrated gas), making it more difficult to get a global overview and concentrating the narrative on the profit (due to record high prices) instead of volumes. With further assets sales in 2022 [5], we can expect Shell to soon lose its third-place position.

-

ExxonMobil’s gas production growth in 2010 was the consequence of buying the US shale gas producer XTO. But since this acquisition, production is trending down, leaving ExxonMobil in fourth position. This year its gas production grew by 0.8%, versus a decline of 2.6% in its oil production.

-

Novatek managed another 3.3% growth in gas production last year, mainly due to the commissioning of gas condensate deposits within the fields of the North-Russkiy cluster (North-Russkoye and East-Tazovskoye), in the third quarter 2020.

-

Chevron’s strong growth (+5.7%) is largely due to the Noble Energy acquisition in October 2020. This takeover has allowed Chevron to grow both its US (+5.1%) and its international (+5.9%) production. It is interesting to note that in the past few years, Chevron is the company that managed to effectively grow its gas production the most, with a 2015-2021 CAGR of 6.5%.

-

TotalEnergies' gas production dropped by 1.6% in 2021, while its oil production was down by 2.8%. Planned maintenance, unplanned downtime and natural field decline are the main reasons.

-

After a massive drop (-15.1%) in gas production in 2020, BP faced another drop in 2021 (-1.6%) [6]. While its gas and low carbon energy segment managed to expand production, the oil production and operations segment reported a massive drop in gas production (-15.9%), due to impact on production-sharing agreement entitlement volumes and the effect of divestments in Alaska and BPX Energy [7]. According to BP "-3.8% was due to impacts from reduced capital investment and decline." And BP expects hydrocarbon production to be broadly flat in 2022 compared with 2021, even with the start-up of Mad Dog Phase 2 in H2 2022 and first gas from Tangguh expansion in 2023.

-

Rosneft witnessed a 3.1% growth in gas production in 2021, even taking into account its asset disposals. Excluding these sales, the growth would have been 14.2%. During the last 10 years, Rosneft has increased gas supply fivefold. We could expect Rosneft to overtake BP in the coming years. In March 2020, Rosneft’s capital structure changed, with Rosneft receiving a 9.6% share of its own equity capital owned formerly by Russia. This participation is held by a 100% subsidiary of Rosneft (LLC RN-NeftKapitalInvest). The 19.75% stake held by BP must now change hands: if “given” back to the Russian government it could allow Russia to recover a majority stake. It could also be sold at a steep discount to a Chinese company, making Rosneft's capital structure less stable.

-

New production from Martin Linge (online since June 2021) and optimised gas production contributed to Equinor's substantial production growth in 2021.

Split of gas production among top ten producers in 2021

Source: company data, thierrybros.com

Forced shut ins and extended maintenance in 2020 resulted in a record high worldwide spare capacity. Natural decline and lower capital expenditure eroded this quickly in 2021. With Russia now a pariah state, we have to fully discount Gazprom’s spare capacity and hence the system is scrambling as there is no other spare capacity available, and European IOCs did not manage to expand output in 2021.

Spare gas production capacity

Source: thierrybros.com

[1] PetroChina on 31 March 2022; Gazprom financial results are not out but production results are available here.

[2] Not all companies provide the exact same units for their reporting; the data here is as “raw” as possible versus that which was provided directly by the companies.

[3] Above 5%.

[4] By taking the company's maximum daily production and compared it with its annual production.

[5] Shell considering sale of British North Sea assets: press

[6] Excluding its Rosneft share. BP is due to exit this shareholding following the Russian invasion of Ukraine.

[7] After completing in 2018 of a $10.5bn acquisition of BHP’s American shale assets, BP’s US onshore oil and gas business — known as BPX Energy — took over operations in 2019 of positions in Texas and Louisiana, while divesting legacy assets in Wyoming, Oklahoma and New Mexico. BPX Energy's gas production went down in 2021 by a staggering 25.8%.

Thierry Bros

April 5, 2022

Professor of Sciences Po & Energy Expert