Gazprom stays on top in 2023 producer rankings [Gas in Transition]

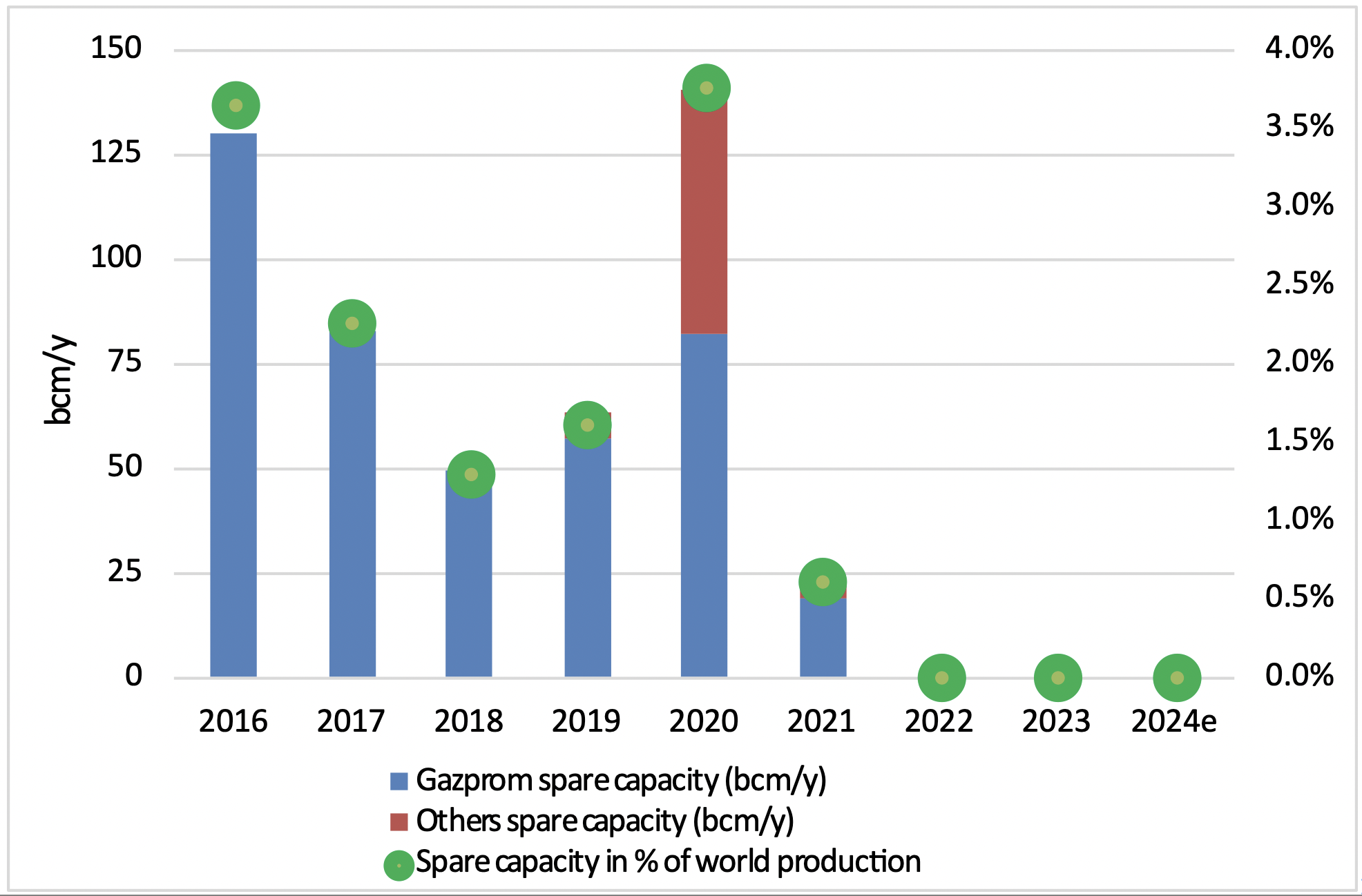

Russia’s Gazprom remains the undisputed leader among top gas producers, with a 10% worldwide share of the market in 2023, followed, just as in the previous year, by PetroChina. As Gazprom was the major provider of worldwide spare gas capacity, the removal of most Russian gas from Europe also de-facto took away this spare capacity.

The inconvenient truth is that three Russian companies are now among the top four major gas producers, alongside PetroChina. The first international oil company (IOC) is Chevron, in fifth position. And since the International Energy Agency (IEA) published its net-zero scenario in 2021, most European IOCs renamed themselves into international energy companies (IECs), pursuing greener less profitable options while producing less gas and becoming de-facto less relevant.

The 2007-2023 evolution of the top gas producers (listed companies producing more than 60bn m3/year)

.png)

Source: Company data, thierrybros.com

The top four companies, headquartered in Russia and China, are producing nearly double as much as the next four Western companies in the rankings. Those are ExxonMobil, then Chevron, then Shell and BP. EU companies, absent from this list, are losing market power.

-

As Russia further cut its pipe exports to “unfriendly” Western countries (-36bn m3 in 2023 versus 2022), Gazprom had to further reduce its production by 15bn m3, or 3.6%. The drop in production is, this year, lower than the drop in its EU exports, showing that the Chinese exports are starting to have a meaningful impact on production data. Even after a 23% drop in the last two years, Gazprom still accounts for 10% of global production, but the future looks bleak with its domestic competitors taking some of its lost market share.

-

PetroChina, with its prioritisation of gas production, overtook ExxonMobil in 2018 and Shell in 2019, and now sits firmly in the second position. Its Gas output was up again by 5.5% in 2023. Gas production reached the highest level in history, and the proportion of gas in its oil and gas equivalent output continued to increase. The marketable domestic natural gas output increased by 6%, while it decreased by 5.1% for overseas production, even as PetroChina increased focus on exploration abroad, making new discoveries in the Doseo Basin in Chad and the eastern margin of Pre-Caspian Basin. The group has actively participated in the “Belt and Road Initiative”, supporting the completion of the North Field Expansion Project in Qatar and signing an agreement on the transfer of operating rights for the West Qurna-1 oilfield in Iraq. PetroChina alone produces nearly as much as the two leading Western companies, Chevron and ExxonMobil.

-

Gas production at Russia’s Rosneft hit a new all-time record of 92.7bn m3 in 2023, up 24.6%. As a result, the company moved from seventh to third position. The 19.75% stake held by BP must now change hands: if “given” back to the Russian government it could allow Russia to recover a majority stake.

-

After a modest growth in gas production, Novatek managed to overtake ExxonMobil to take the fourth position.

-

Chevron’s gas production was slightly up in 2023, by 0.9%, overtaking ExxonMobil.

-

ExxonMobil’s gas production growth in 2010 came as a result of its purchase of US shale gas producer XTO. But since this acquisition, production has been trending down, leaving ExxonMobil in sixth position, down two places versus 2022. In 2023, its gas production dropped by 6.8% versus an increase of 4% for its oil. The $59.5bn merger with Pioneer announced in October last year will allow ExxonMobil, at closing, to more than double its Permian production to 1.3mn barrels of oil equivalent/day. This should allow ExxonMobil to reiterate its 2010 gas growth jump. This proves that, as expected, it is easier and safer for major US companies to concentrate on US unconventional production versus conventional production outside the US for both security and flexibility.

-

Shell again witnessed a drop, of 5.3%, due to supply issues and divestments. As expected, Shell continues to lose ground in this ranking, and is now in seventh position. The former green narrative to divest away from oil and gas is now having its effect, and could become difficult to fast overturn. On March 14, Shell softened its targets for carbon emission cuts in a strategy update. Shell now aims to reduce its net carbon intensity by 15-20% by 2030, compared with a previous target of 20%.

-

BP grew its total gas production by 1.2% in 2023, and “expects both reported and underlying upstream production to be slightly higher in 2024 compared with 2023,” thanks again to strong growth at its subsidiary bpx energy, which boosted gas flow by 16.6%.

-

Equinor gas production decreased by 5.7% in 2023. In 2022, responding to the energy crisis unfolding in Europe, Equinor’s gas production in Norway increased by 8.5% at the expense of liquid production, which dropped 5.9% versus the level in 2021. With the energy crisis easing in Europe, Equinor switched to focusing on maximising long-term oil output, at the expense of Norwegian gas, which fell by 6.8%.

-

TotalEnergies’ gas production dropped substantially in 2023 versus 2022, due to the deconsolidation of its stake in Novatek as of January 1, 2023. With 52bn m3 produced in 2023, TotalEnergies dropped off the list of the top eight gas producers.

2023 split of gas production (listed companies producing more than 50bn m3/year)

.png)

Source: Company data, thierrybros.com

With Russia a pariah state since 2022, the global gas system has no spare production capacity available, making the gas prices more volatile.

Spare gas production capacity in 2023

Source: thierrybros.com

But if China, the world’s third largest gas consumer and fourth producer, is becoming not only the top LNG buyer but also an astute player, soon set to account for more than the entire EU, it could make sure Europe pays a premium for its LNG.

Thierry Bros

April 3, 2024

Energy Expert & Professor