Gas-on-gas pricing sees continued rise in LNG markets [Gas in Transition]

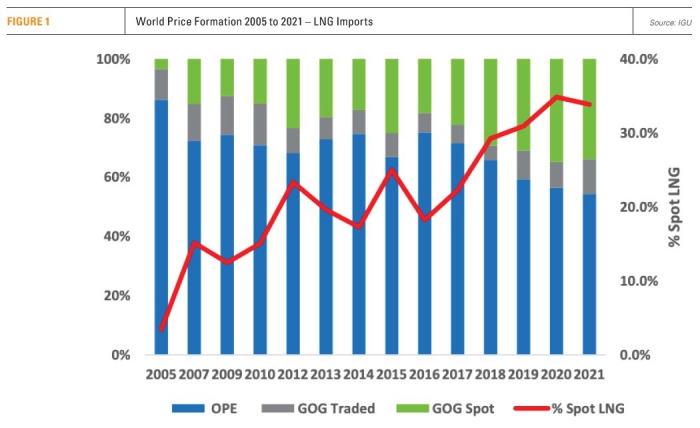

The IGU’s Wholesale Gas Price Survey 2022 Edition, presented in London in early October, found that Gas-on-Gas (GOG) competition in LNG markets rose by 18 percentage points in the period 2005 to 2021. The share of GOG in total global LNG imports stood at 46% in 2021, up from 44% in 2020.

“More contracted LNG volumes tied to hub prices, especially Henry Hub, has been behind the trend,” the report, which was IGU’s 14th annual survey, said.

GOG refers to LNG going to the traded markets of North America and Europe – the UK, Belgium and Netherlands – and any hub-indexed LNG contracts and spot LNG cargoes shipped to Europe, Asia Pacific and other markets. The other main pricing model is what the IGU calls Oil Price Escalation (OPE) whereby the price is typically linked to crude oil, gas oil and/or fuel oil.

In Europe, 67% of LNG imports was GOG in 2021, the report noted. With increasing levels of gas imported as LNG, and much less pipeline gas coming from Russia, the rising share of GOG could well continue.

"In 2021, before the surge in LNG coming in then in Europe as a whole about two-thirds was actually gas-on-gas or market pricing, one third was oil indexation,” Mike Fulwood, senior research fellow at the Oxford Institute for Energy Studies (OIES), said during the presentation of the report at a conference in London hosted by Energy Intelligence.

“With the 60% increase or 50bn m3 more LNG coming to the European market, that is pretty much all hub priced. Probably now 80% of the European market is gas-on-gas competition."

The IGU report noted that the growing share of total GOG in LNG imports was a continuation of the trend that took off in 2017. The total GOG share of LNG imports back in 2016 was much lower at 25%.

In 2021, and for the first time since 2016, the share of spot LNG on the global market fell slightly; to 34% in 2021 compared with 35% in 2020. However, the sharp rise in LNG cargoes

imported into traded markets, and those linked to hub prices, meant that the overall share of GOG in LNG imports was up, the report said.

In terms of volume, GOG LNG imports totalled 230bn m3 in 2021 compared with 274bn m3 for OPE.

In 2021, the year/year rise in GOG largely reflected a large increase in spot LNG cargoes to Latin America, mainly Brazil, as well as Asia Pacific and China. There was also a switch away from OPE cargoes to GOG in Europe, according to the report. Meanwhile, the volume of spot LNG cargoes have risen two and a half times in four years, from 63bn m3 in 2016 to 170bn m3 in 2021. China is the biggest spot LNG importer, closely followed by Japan.

As for pipeline imports, GOG had a share of 63% in 2021, totalling 44bn m3, with Europe at 302bn m3, North America 134bn m3 and the former Soviet Union 7bn m3. Back in 2005 the share of GOG in pipeline imports was just 23%.

“Most of the European gas importing countries, outside Turkey and Spain, are now

dominated by GOG pipeline imports with the top five countries being Germany, Italy, France, Netherlands and UK,” the report said.

In 2021, the GOG share in pipeline imports actually declined by 2 percentage points year-on-year with the volume of OPE rising sharply in Turkey and Spain, “reflecting a faster increase in demand than elsewhere in Europe and a rise in China’s pipe imports from Central Asia and Russia,” the IGU said.

OPE accounted for around 28% of all global pipeline imports in 2021, totalling some 197bn m3, with Europe at 98bn m3 and Turkey being by far the largest contributor there. OPE in Asia accounted for 55bn m3 of pipeline imports.

As for total world consumption, the GOG share rose from 31.3% to 49% between 2005 to 2021 with the OPE share falling from 24.3% to 19.1%, according to the report.

Global gas prices diverge

IGU’s analysis showed that global gas prices converged continuously from 2005, indicating further globalisation of the gas markets, but only up until 2017.

The increasing convergence then stalled and in 2021 prices diverged again, largely eliminating the convergence since 2005 as spot prices rose sharply.

“The extraordinary price developments in the global gas markets in 2021 clearly have had a different impact in individual countries and subsets of countries,” the report said. “2021 and into 2022 has seen unprecedented increases in spot prices globally and also in price volatility, from the depths of 2020 as Covid-19 crippled the world economy.”

The IGU also highlighted that gas markets have been prone to significant price swings in recent years; from abundant supply and relatively low prices to gas shortages and price spikes.

The report noted that in 2019, prices in Asia and Europe were on a downward trend with plentiful new LNG supply coming to the market, against the backdrop of only slowly rising demand. Prices then dipped briefly below $4/mn Btu in Europe. As COVID-19 hit in 2020, global demand fell, with supply continuing to rise in the first half of the year.

Prices collapsed further – TTF reached a low of $1.55 in June 2020, JKM a

low of $2.06 in July 2020 and Henry Hub a low of $1.50 in the same month.

“The result was that a lot of LNG cargoes, especially from the US, were shut-in during the summer of 2020,” the report noted.

Gas demand started rising again in winter 2020/21 owing to cold weather in Asia, Europe and Russia.

LNG was diverted to Asia and prices in Europe remained subdued because of high levels of gas in storage. Gas production in Russia was at record high levels through 2021 but much of that was needed to meet domestic demand and also refill depleted Russian storage.

As the world economy recovered from COVID-19, and a lack of rainfall in Latin America led to reduced availability of hydropower in Brazil, LNG imports started rising again. At the same time LNG export capacity was declining rather than increasing with extended maintenance at a number of liquefaction plants as operators were catching up from missed maintenance periods in the COVID-hit 2020.

The pattern of strong demand and tight supply continued into 2022 but the report noted that a large share of GOG is a fundamental reason why the global gas market has been able to respond “very effectively to the significant change in LNG demand and changing LNG flow needs.”

“GOG pricing, whether as spot LNG or into traded markets, is the very definition of

flexibility, which is what is required in the current turbulent market,” the report said. “In other words, the market was able to send effective price signals, for the supply to go to where it was needed most in a situation of an extremely tight market, with no excess capacity and demand growth outpacing new supply additions.”

A tight supply and demand balance is expected to remain for some time and could tighten further next winter due to an expected absence of Russian gas to fill up European storage tanks in summer.

However, LNG liquefaction capacity is expected to increase sharply towards the end of the decade with new projects coming online in the US and Qatar.

"In 2026/27 there is a whole wave of LNG coming on. Our estimates are that by 2028, compared to last year, there is 50% more LNG export capacity on the market. To some extent we think that even with zero Russian gas coming to the European market we can well rebalance the market," Fulwood said.