France Says Green Gas Could Meet 30% of 2030 Demand

France’s main gas transmission network GRTgaz and three smaller partners estimate that gas from renewable sources could provide up to 30% of France’s gas consumption by 2030, with the right incentives.

The assessment is given in their 2017 provisional multi-year forecast, published November 21, the second time that French gas infrastructure operators have published such an outlook out to 2035.

In its incentives-based ‘gone green’ scenario, renewable gas could thus reach 90 terawatt-hours of gas (8.4bn m3) annually by 2030. But that presupposes targeted support measures to accelerate rollout of: biomethane production, incentives for gas use in vehicles, and promotion of ‘new types of green gas’ – understood to include some power-to-gas.

France’s gas consumption in 2016 was 487 TWh (45.3bn m3) , 5% higher than in 2015, according to the report 'Perspectives Gaz 2017'. About half the 2016 gas was used in households, offices and shops; 34% by industry and 15% (or 73 TWh) in power generation.

Excluding power generation, the report's baseload scenario sees gas demand declining by 1.2%/yr from 413 TWh in 2016 to 364 TWh in 2035, thanks to energy efficiency gains.

The report also includes two other scenarios (again, excluding gas used for power): an incentives-driven green one in which 2035 demand would slightly rise to 417 TWh; and a pessimistic one for the gas sector in which it would tumble to 316 TWh. The report though includes graphics for all three scenarios that include a higher line factoring in gas used in power generation.

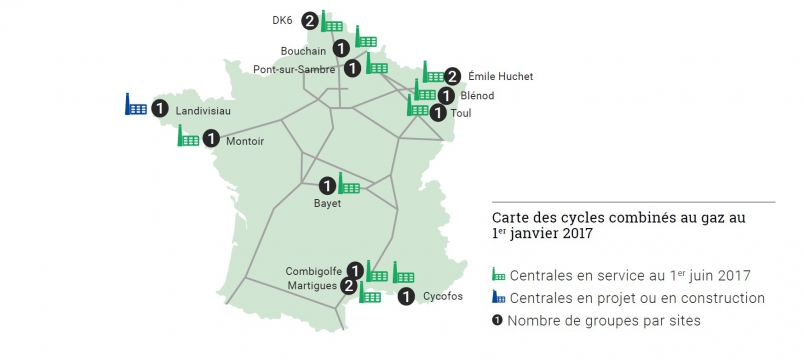

Indeed, the report shows gas demand from power production rising above 90 TWh in 2035 but admits to uncertainty about how nuclear (France’s main source of electricity production today) and renewables develop (see graphic below).

Last year 15,000 vehicles consumed 1 TWh of gas, and that was mainly used by trucks. By 2035, new incentives for biogas used by trucks could increase the natural gas vehicle (NGV) fleet to between 300,000 and 1mn vehicles representing about 10% of the country’s gas demand, the report says. The government this year outlined measures to promote NGVs, as part of its long-term strategy.

The three other groups that co-authored the report are TIGF, SPEGNN and GRDF. TIGF is the southwest France gas transmission network managed and 40.5%-owned by Italy’s Snam. SPEGNN represents smaller local authority-owned local distributors, while GRDF is the main distribution operator. Both the latter and GRTgaz are controlled by Engie.

Map from p34 of the 'Perspectives Gaz' 2017 report showing CCGTs already in operation June 1 2017 in green, and those planned or under construction in blue