Elements of an Optimal Fiscal Regime for Romania’s Offshore Sector

Context

The Energy Policy Group (EPG) organized on 21 May 2015, with the support of the Romanian Black Sea Titleholders Association (RBSTA), a roundtable on The Romanian Offshore Petroleum Fiscal Regime. Participants included representatives of relevant public institutions (the Romanian Government, the National Agency for Mineral Resources, the Romanian Parliament), representatives of RBSTA member-companies, fiscal and legal consultants, academia and specialized press. Talks were held in accordance with Chatham House rules.

The roundtable was organized in the context of the Romanian Government being in full process of drafting a new oil and natural gas (O&G) fiscal framework. Clarifications in this area are necessary and expected by investors and public opinion alike. The fiscal system is a decisive factor for O&G operators. It is the main tool for distributing revenue between state and investors and it must offer a fair, win-win outlook on the long term.

The investment cycle of an oil project is long-term – typically 25-30 years, or longer for offshore projects. In addition, offshore projects in particular require large upfront exploration capital investments. Also, the investment risk for offshore exploration activities is high, and the cost recovery timeframe can be over a decade.

Therefore, the details of the upstream fiscal framework will be extremely important as companies are hoping to move towards commerciality, since it will generate major long-term effects.

This policy paper summarizes the talks at the roundtable and puts forward, based on presented data and arguments, recommendations for political decision-makers in the Government, the National Agency for Mineral Resources (ANRM) and the Romanian Parliament. It also aims to offer the interested public clear and useful information on a topic that frequently raises emotional and disproportionate assessments.

The economic and strategic importance of Romania’s offshore sector

Amid a trend of natural decline of the Romanian hydrocarbon production of about 10% per year, the development of new sources is an economic and energy security imperative. The Black Sea has the prospect of becoming a new natural gas production basin thanks to past years’ investments in the deep waters of Romania’s exclusive economic zone.

Geological explorations by several international oil companies in Romanian offshore perimeters are in full gear and public results are encouraging. Nevertheless, no declaration of commerciality has been submitted as of yet, so the basin’s development and production phase is still uncertain, depending on the alignment of various factors, of which the fiscal policy is fundamental.

Natural gas production in the Black Sea waters could profoundly transform the Romanian energy security status and generate sustained economic activity, as well as provide additional income to the national budget.

In a geopolitical environment tensed by the Ukrainian crisis and against the background of an oligopolistic Central and Southeast European natural gas market, reducing dependency on imports and raising production above current demand levels will increase the political and economic autonomy of our country. Through interconnections with regional markets, in accordance with the European Union’s (EU) energy security strategy, Romania will be able to maximize its domestic gas use and better manage possible regional gas supply crises.

Romania must set its strategic priorities and invest in the development of international natural gas transportation projects that will allow the domestic market to develop and increase producers’ access to a larger market. It is in Romania’s national interest that the Black Sea gas production be taken over into the National Gas Transportation System.

The offshore sector represents a strategic priority for the Government, which seeks to offer investors a stable and fair regulatory framework.

Romanian offshore investment risks

A growing part of the world’s O&G production comes from offshore development. Technological progress allows for ever deeper offshore drilling, but with a rising level of investments. Production potential is very important given the fact that 70% of estimated offshore resources have not yet been explored.

However, the trend is accompanied by ever more significant risks:

Major increases in discovery costs. Over the past 10 years, drilling a well grew, on average, four times more expensive.

First revenues may not occur until approximately 10-15 years after the investment’s start.

Increased uncertainty of resource potential. The average success rate of offshore exploration drilling is 20-25%.

Necessary infrastructure is more and more complex and expensive.

Oil price volatility on international markets is a major commercial risk.

Greater exposure to weather conditions.

Geopolitical risks. Political sanctions and/or diplomatic and military tensions may affect the conduct of offshore operations.

Fiscal and regulatory risks. With a long investment cycle and high upfront costs, the O&G sector – and especially the offshore one – faces time inconsistency problems: before making major capital investments in the exploration and development phases, the risk factor is higher and the state is willing to offer incentives. After investments are made and higher risk factors have been mitigated, the state has the tendency to revise contractual terms in order to appropriate a larger share of the benefits.

In addition, Black Sea activities present a series of specific risks:

The Black Sea is less geologically explored having a difficult topography, which in turn makes pipeline construction significantly more difficult.

The Black Sea deep waters are highly corrosive, therefore special, expensive technology is needed.

Proved Black Sea reserves are mostly of natural gas, with smaller market value than oil, although the required exploration, development and production investments are equally large.

Lack of natural gas transportation infrastructure.

Limited availability of offshore support services.

Increased mobilization costs, because of difficult access through the Bosporus Straits.

Increased geopolitical risk in the region.

At the moment, the oil price drop complicates commercial viability assessments of the Black Sea offshore deposits, despite operators’ decision not to decrease exploration budgets.

Thus, Black Sea offshore projects’ road from discovery to development, production and marketing is still long and fraught with uncertainty.

Elements of an optimal offshore fiscal regime

Cooperation between investors and authorities is crucial for reducing regulatory risks, of which fiscal risk is only one type, albeit fundamental.

For example, consistent with worldwide offshore oil industry best practices, appropriate Romanian legislation that has an impact on O&G operations must be adjusted and enacted in order to facilitate an optimal working model for the offshore industry. Ambiguities and contradictions concerning authorization and permitting procedures must be addressed and resolved. The authorities are working in consultation with O&G operators’ associations on harmonizing the Petroleum Law and clarifying its provisions in order to ensure the required international standards and practices.

For the reasons mentioned above, the Government must acknowledge that offshore projects are in very early stages and there are still considerable challenges to be taken on by investors, not only from a technological point of view, but also from a financial and commercial one.

If the fiscal terms set up by the Romanian Government reflect the investors’ risk tolerance at the time of the initial investment and the terms do not change unexpectedly over time and are predictable, then the investors can assume a long-term economic return of investments in Romania and the Black Sea. At the same time, the Romanian Government should recognize the unique challenges associated with offshore exploration in a clear, fair and distinct fiscal regime.

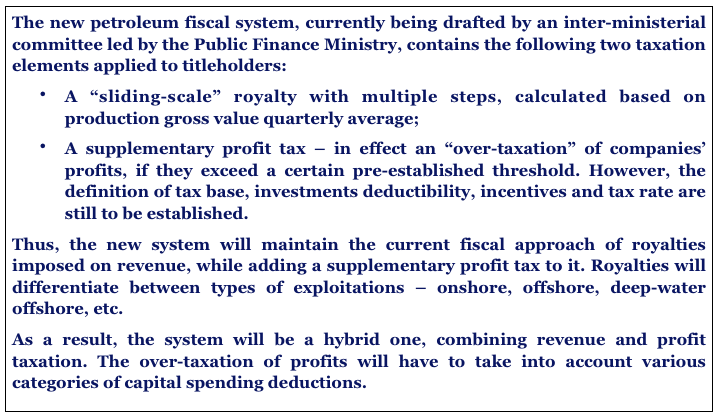

Through the new O&G fiscal framework, the Government intends to obtain a larger share of the economic rent from the exploitation of hydrocarbons. It is likely that the Parliament will pass the changes this fall.

Stabilization devices of the petroleum fiscal system

The authorities want to create a stable and flexible fiscal system, capable of underpinning a sustainable partnership between state and investors. They are familiarized with the ample and diverse risks confronting the offshore hydrocarbons projects. Consequently, the need for distinct regulation of the offshore sector is broadly accepted.

Stability clauses, as part of petroleum agreements, are considered as stabilization mechanisms for the upstream fiscal system. They establish that the fiscal terms agreed upon when signing the concession agreement remain in force throughout the agreement’s duration. Also, “most favored contractor” clauses can be used, by which titleholders are to receive the better conditions that may result from changes to initial terms.

In this respect, offshore investor’s expectation is that no additional taxes should be added to an emerging industry such as the Black Sea offshore. Changing terms after investments have been madepenalizes early investors and adds another layer of unpredictability about final investment decisions. However, resources offshore Romania would bring additional revenue to the state budget if they are developed.

The Government’s credibility to elaborate the new O&G fiscal regime as well as its commitment to build a win-win framework for state-investor relations also depends on following public consultation procedures, both with the business community and the interested public. The Government and the regulator have given assurances that the procedure will be thoroughly followed, with no ad hoc decisions. A draft version of the petroleum fiscal regime is to be made public in July, after consultation with O&G companies, and open for public consultation during the parliamentary break, until the beginning of September. In September and October, the Parliament is to debate the legislative proposal.

Finally, the increased efficiency of the Romanian judicial system should offer investors additional assurance when it comes to enforcing the terms stated in the petroleum agreements. Nevertheless, it was noted that the introduction of a special constructions tax on 1 January 2014 also affected the older concessions.

Petroleum fiscal system optimization principles

Efficiency, adaptability and sustainability of the new upstream fiscal system will depend on the quality of employed fiscal mechanisms and their parameters’ values. Details have very important long-term consequences in the O&G sector.

The petroleum fiscal regime should limit the impact of “regressive” elements (production or revenue-based resource rents), as this will improve the correlation of investor’s profits with capital spending. More technically put, oil companies employ factors of production until the marginal return on each factor equals the marginal economic cost. Nevertheless, a fiscal system based on royalties calculated as percentage of production decreases the marginal return but not the marginal cost, which in turn diminishes incentives for investments.

For example, the royalty for gas production is the same, at equal production volumes, regardless of increasing extraction costs over time. This will lead the operator to reduce the level of investment. Hence, taxing production or revenues is equivalent to a regressive oil taxation system – higher cost/lower profit firms end up paying more royalties relative to their profit than low-cost firms. On the other hand, a profit-based taxation system encourages companies to invest until marginal return on the last unit invested just about covers the marginal economic cost. Thus, state and investor’s interests are aligned as both parties are incentivized to increase revenue from a project.

For large projects – such as offshore ones, because of their large exploration and operation costs – profit-based taxation is the most efficient,as it will better encourage marginal production and thus allow the state to maximize economic rent capture.

Although profit-based taxation better aligns investor incentives with maximum recovery of the marginal resources, it is also recognized that some fiscal mechanism should be put in place to ensure Government revenues in all years of production (prior to the project as a whole having become profitable). Revenue-based resource rents accomplish this objective. As such, it may be appropriate to have a relatively small revenue-based resource rent in the early years of production that is replaced by a profit-based take once the costs have been recovered and the project generates profits.

From a practical viewpoint, it is important that the new fiscal system relies on benchmarking resulting from comparative studies and rigorous quantitative modeling. Romania is competing regionally for attracting offshore investments, so it has to offer competitive fiscal terms. Quantitative modeling of the O&G fiscal system’s functioning, under multiple market scenarios, is an essential tool for fine-tuning fiscal parameters. Both the ANRM and the International Monetary Fund are to perform quantitative modeling of the new fiscal system’s functioning.

Recommendations

As the principles of the new O&G fiscal regime seem to be already decided upon, attention must now be paid to its parameters.

This policy paper has presented the characteristics of offshore operations and the particular risks associated with them. In order to stimulate offshore investments, the upstream fiscal system must substantially differentiate the treatment of the offshore sector, and then distinguish between shallow water and deep water operations. Fiscal conditions must be attractive and stable. Stability clauses in the existent petroleum agreements must be properly considered. This is the only way to build a long-term, win-win partnership between state and offshore investors.

It may be appropriate for fiscal terms to evolve over time due to changes in risk factors. However, to attract and retain investors, most countries recognize the principle of “grand-fathering”, whereby terms of existing contracts are kept consistent with levels agreed upon when the initial investments were made, and the terms of new agreements are adjusted to the changing risk profile.

Details of the new fiscal system must not be set without substantive comparative analysis of practices in other producing countries comparable with Romania, and without relevant quantitative modeling of the system’s functioning. Romania finds itself in a regional competition for attracting offshore investments. It is in the long-term interest of both investors and the state to encourage investments in exploitation optimization with the continuous use of latest technologies. Lack of such investments will result in suboptimal field operation on the long run, consequently decreasing state revenues.

The public consultation process must be of substance and provide enough time to all interested parties to express their positions. Reasoned proposals and positions must be analyzed carefully. It is in the interest of both the state and investors that the resulting fiscal system be balanced and socially acceptable, as this is the only way to assure long-term political stability, essential in O&G development. The consultation process should be transparently resumed as often as the Government considers changing the regulatory system, and especially the fiscal one.

The Romanian Government must strategically coordinate the planning and execution of the needed onshore gas transportation infrastructure in order to be able to take over Black Sea offshore production, with access to European markets. The institutional and administrative framework for internal gas market development must also be coordinated accordingly. On the other hand, companies must plan and coordinate building the necessary offshore transportation infrastructure up to the entry point into the National Gas Transportation System.□

The Energy Policy Group (EPG), a Natural Gas Europe Knowledge Partner, is a Romanian nonprofit, independent and non-partisan think-tank specializing in energy policy, market analytics and energy strategy. EPG’s regional focus is Eastern Europe and the Black Sea Basin, yet its analyses are informed by wider trends and processes at global and EU levels.