Egypt’s energy woes [Gas in Transition]

Egypt’s natural gas production has declined dramatically from the highs attained in 2021, at just over 7bn ft3/d, to 5.88bn ft3/d during Q2 2023 – a 17% reduction in 3 years – and it is still declining. According to MEES, this is largely due to water infiltration problems at the giant Zohr gas field, where production has plummeted from a high of 2.76bn ft3/d in 2021 to 2.3bn ft3/d now, about 23% below the field’s production capacity of 3.2bn ft3/d.

And it is not just Zohr. The problem is exacerbated by declining output from the Western Desert, West Delta Deep Marine (WDDM) and onshore fields in the Nile Delta.

It is also due to the fact that no significant new discoveries have been made since that of Zohr in 2015, other than the modest discovery of the 3.5-trillion ft3 Nargis gas field north of Sinai, announced by Eni and Chevron in January this year – with development expected to start next year. As a result, natural depletion of Egypt’s gas resources due to annual consumption and export is not being replaced, contributing to a steady decline in output. This trend comes as demand continues to rise as Egypt’s population, now at 111mn, continues growing fast at a rate of 1.6% annually. Coupled with Egypt’s dire economic situation, this is a major challenge.

The expanding gap between supply and demand means the country is now in the grip of power shortages and electricity blackouts as the summer heatwave drives demand for cooling to peak. In July, Egypt introduced measures to limit power outages, including electricity rationing and a 20% cut in gas supplies to fertiliser factories, that are expected to remain in force until September. The Egyptian Electricity Company even issued a warning to citizens, urging them to avoid using elevators at specific times for safety reasons, sparking anger.

Adding to the challenge, even though Egypt’s plans were that the supply of electricity generated from renewables would reach 20% of the mix by 2022, it only achieved 11%. Egypt is targeting 42% of power generation from renewables by 2030. If achieved, that could certainly help address the country’s current energy woes, but serious doubts hang. Egypt plans to address these issues in a new energy strategy announced in June.

An additional challenge is Egypt’s continuing financial crisis. It is finding it difficult to maintain payments to international oil companies for the oil and gas they are contracted to sell to state companies. This could impact their willingness to make new investments.

Gas shortages

Zohr accounts for about 40% of Egypt's total gas production. As a result, any problems with Zohr have an outsized impact on the country’s gas resources.

Eni has embarked on a repair and drilling programme to increase Zohr’s production, but without new discoveries, Egypt’s gas woes are expected to continue. Hopefully increased exploration activity and the new offshore licensing rounds being launched this year will eventually lead to new finds.

Oil and natural gas constitute about 93% of Egypt’s primary energy sources, but the country’s production meets only about 75% of domestic consumption. The rest is imported. With natural gas being the most important fuel in Egypt’s power energy mix – it accounted for 77% of generation in 2022 – but also key to its economy through LNG exports, imports from Israel to supplement falling domestic production are becoming particularly important to the country’s energy security.

Israeli gas imports

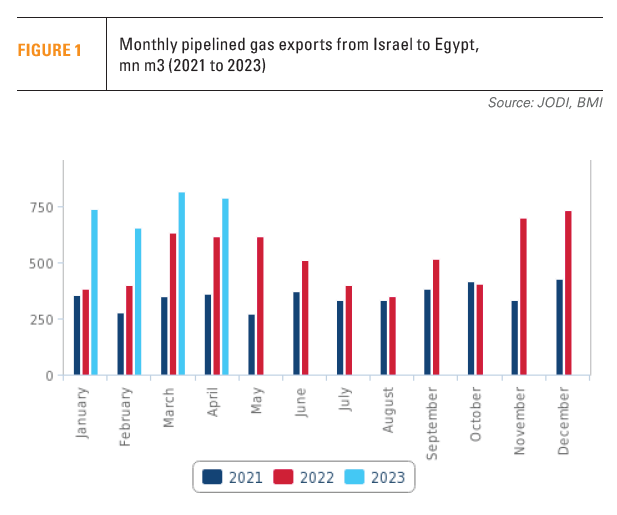

Egypt started importing gas from Israel in 2020. By 2002 it was importing an average of 0.6bn ft3/d, but this has now risen close to 0.9bn ft3/d (see figure 1).

At a recent meeting between the heads of Egyptian intelligence and Israel's National Security Council, Egypt is understood to have pressed Israel to increase gas exports. With a price claimed to be close to $7.50/mn Btu, this is attractive to gas-producing companies in Israel. Chevron is expanding production at Tamar, from about 1bn ft3/d to 1.6bn ft3/d, and Leviathan, from about 1.2bn ft3/d to 2bn ft3/d, for this purpose. It plans to more than double gas exports to Egypt, to about 1.9bn ft3/d by 2027.

This will be facilitated by the approval in May of a second pipeline aimed at boosting Israel-Egypt gas flow. This will link Israel’s southern gas network with Sinai by 2025.

In late August, the Israeli government approved plans to expand gas production capacity at the Tamar gas field by 60%. Energy minister Israel Katz described this as an “important step that will increase the state's income and strengthen the political relationship between Israel and Egypt.”

Israel uses natural gas exports to enhance its regional status, but also to ensure political stability in Egypt. Gas exports strengthen its relationship with Egypt, especially given the latter’s desperate need for those supplies, provided its dire economic situation does not affect its ability to pay.

Cypriot gas imports

A formal announcement on Cyprus’ Aphrodite appraisal drilling results is expected by the end of August, but Chevron has every reason to be happy. Unconfirmed sources put the gas field’s updated reserves up by 15%.

Speaking during Chevron’s second-quarter 2023 results webcast, Chevron CEO Mike Wirth, CEO Chevron confirmed "our Aphrodite appraisal well in Cyprus met our expectations." He went on to say "we're pleased with the outcome…We have submitted our development plan to the government for their approval and it involves a capital efficient way to take the gas to market via subsea tiebacks to existing infrastructure," adding that "this is all pending government approval and if we get that, we could be into front-end engineering and design later this year."

In May, Israel’s NewMed submitted on behalf of its partners Chevron and Shell a development plan for government approval. This is based on exporting an estimated 0.65bn ft3/d gas by subsea pipeline to Shell’s existing, underutilised, WDDM facilities in Egypt for treatment and export to the Egyptian gas system. It is expected that some of the gas will be liquefied at Shell’s Idku facilities for export, with the remainder destined for domestic consumption. It is the use of the WDDM facilities that makes the plan commercially attractive to Chevron and its partners.

In May, Israel’s NewMed submitted on behalf of its partners Chevron and Shell a development plan for government approval. This is based on exporting an estimated 0.65bn ft3/d gas by subsea pipeline to Shell’s existing, underutilised, WDDM facilities in Egypt for treatment and export to the Egyptian gas system. It is expected that some of the gas will be liquefied at Shell’s Idku facilities for export, with the remainder destined for domestic consumption. It is the use of the WDDM facilities that makes the plan commercially attractive to Chevron and its partners.

Cyprus’ ministry of energy initially rejected the proposed modifications to the 2019 original development plan. It is understood to be pressing for some of the gas to be sent to the island to replace oil for power generation. However, with Chevron proposing gas treatment to be carried-out in Egypt, it precludes sending untreated gas to Cyprus. It is technically challenging and expensive. There is positive intent from both sides to find common ground during the negotiations that will now follow.

It is understood that Eni may be considering a similar plan that involves sending gas from its discoveries in Cyprus’ block 6, Cronos, for treatment at Zohr’s underutilised facilities, for onward export to Egypt.

Solution of the Cyprus problem is crucial in this context. Hopefully Tukey’s rapprochement with Greece, Israel and Egypt, and its need of Europe’s goodwill and cooperation, driven by its economic woes, will offer a new opportunity.

Egypt’s LNG exports

Last year was Egypt’s most successful in terms of revenues from LNG exports that rose to $8.4bn, in comparison to $3.5bn in 2021, providing relief to its beleaguered economy. But even then, total exports reached 8.9mn tonnes, compared with the 12.2mn t/yr combined capacity of the two liquefaction plants at Idku and Damietta.

In part this was achieved by measures that reduced the supply of gas for power generation – contributing to electricity cuts – freeing gas to maintain lucrative LNG exports.

With gas production continuing to decline and high temperatures persisting, LNG exports during the first quarter of 2023 were limited to 1.9mn t. By April, Egypt's trade deficit surged 23.8% over the same period in 2022, driven by a reduction of over 75% in LNG exports. Egypt did not export any LNG in June and exported only one cargo in July.

As a result of having to divert more gas for power generation, Egypt was forced to curtail its lucrative LNG exports in the summer and will not be able to resume these until October, despite increasing gas imports from Israel. However, with high temperatures not abating and with gas production continuing to decline, the country’s ability to return to the levels of LNG exports seen last year is becoming questionable.

These continuing problems challenge Egypt’s ambition to become a major regional energy hub. They also challenge the country’s ability to maintain, let alone increase, LNG exports to Europe, as envisaged by the MoU it signed with the EU and Israel in June last year.

Some have gone as far as to suggest that these problems signal the end of Egypt’s ability to grow its LNG exports. But that may be premature. Increased gas imports from Israel and a boost in exploration and drilling may yet help reverse the decline.

Exploration and drilling

Egypt hopes upcoming drilling campaigns from key operators will unlock the gas riches in the country’s prolific offshore Mediterranean necessary to reverse the decline in production. Petroleum minister Tareq El Molla hopes that the country will attract as much as $8bn in foreign investment in its oil and gas sector this fiscal year.

Egypt’s petroleum ministry announced in July the start of a $1.8bn programme to drill natural gas exploration wells in the Mediterranean Sea and Nile Delta, involving Eni, Chevron, ExxonMobil, Shell and BP. The aim is to drill 35 exploration wells over the next two years.

Shell commenced a new drilling campaign mid-August that will see it drill nine wells by mid-2025. This will involve six exploration wells, but also three development wells at WDDM. Shell and its partners agreed to kick off the 10th phase of the development of the WDDM concession this year.

BP is planning to follow with a plan to drill four wells during 2024 at its West Raven and NW Aby Qir blocks. ExxonMobil also plans to expand its upstream exploration in Egypt, following on from securing exploration rights to two offshore blocks situated in the outer Nile Delta in January.

BP is planning to follow with a plan to drill four wells during 2024 at its West Raven and NW Aby Qir blocks. ExxonMobil also plans to expand its upstream exploration in Egypt, following on from securing exploration rights to two offshore blocks situated in the outer Nile Delta in January.

But it is by no means plain sailing. There have also been disappointments, such as Eni’s recent dry wells at Nesr-1 in the NEHO block and its Thuraya prospect. Many hopes were pinned on the latter, but drilling earlier this year was a disappointment. However, Eni plans to continue drilling, starting with an exploration well in its North East Hap’y concession.

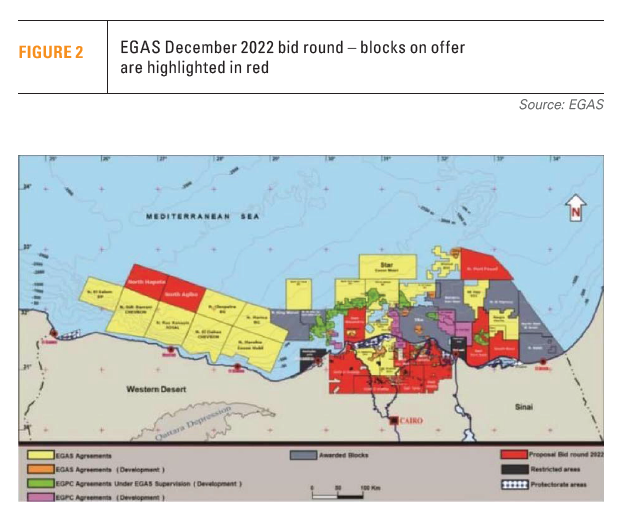

Egypt is pursuing new bid rounds to bolster its flagging gas production through new discoveries. The Egyptian Natural Gas Holding Company (EGAS) launched a new bid round in December that includes six offshore and six onshore blocks (see figure 2). The deadline for submission of bids was extended to July.

Egypt also announced in June that it plans to launch new bids for oil and gas exploration in 16 blocks in the country’s south and the Red Sea by the end of 2023. One of these of the rounds will involve 8 blocks affiliated with the Egyptian General Petroleum Corporation (EGPC), while the second will involve 8 blocks affiliated with the South Valley Egyptian Petroleum Holding Company (Ganope).

Undoubtedly though, until new exploration and drilling produce results, over the next few years Egypt’s energy woes are likely to persist.