Egypt Unrest: What it Means for LNG Trade

The recent unrest in Egypt and the overthrow of President Mohamed Morsi is again giving the energy markets jitters reminiscent of the uprising in 2011 that ended Hosni Mubarak’s 30-year rein. Then, as now, most attention is focused on oil markets and possible disruptions of tanker trade through the Suez Canal. But with increased worldwide attention focused on liquefied natural gas (LNG) trade, it’s important to note that approximately 13-14% of global LNG trade passes through the Suez Canal.

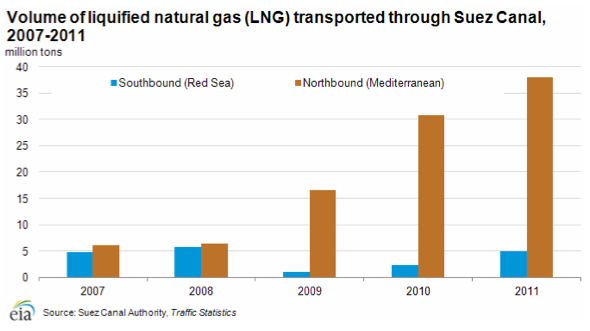

FIgure 1 (Source: US EIA)

According to the US Energy Information Agency (US EIA), LNG transit through the Suez Canal has been on the rise since 2008, with the total number of LNG carriers increasing from approximately 210 to over 500, and volumes of LNG traveling northbound (laden tankers) increasing nearly six-fold.

Figure 2 (Source: EIA)

The rapid growth in LNG flows through the Suez Canal is primarily due to the startup of five LNG trains in Qatar in 2009-2010. (Figure 3) Northbound LNG transit through the Suez Canal is mostly from Qatar and Oman, and destined for European and North American markets. Southbound LNG transit originates in Algeria and Egypt, and is generally destined for Asian markets.

Figure 3 Suez Canal transiting of Qatari LNG carrier "Mozah" (On April 9, 2009, Qatargas celebrated the ‘Suez Canal transiting’ of its Q-Max LNG carrier “Mozah” with a ceremony at the headquarters of the Suez Canal Authority in Ismaila, Egypt. The “Mozah” was carrying 135,400 cubic meters of LNG bound for South Hook LNG Terminal in Milford Haven, Wales. Source: SouthHookGas, www.southhookgas.com)

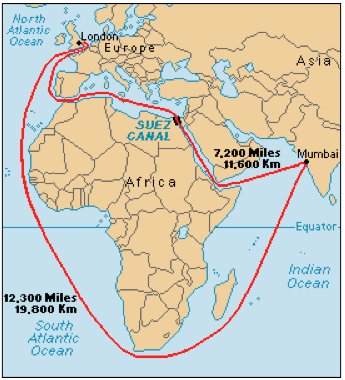

The only alternate route for LNG tankers would be around the southern tip of Africa, the Cape of Good Hope, which would add about 6,000 miles to transit, increasing both costs and shipping time. According to the US EIA, re-routing shipping trade around Africa would add 15 days of transit to Europe and 8-10 days to the United States.

Figure 4 Suez Canal Reduces Shipping Distances (Source: geography.howstuffworks.com)

For the moment, it’s unclear whether there is likely to be any physical disruption to LNG trade caused by the recent turmoil in Egypt. What is potentially more significant to global LNG trade going forward is the increasingly precarious nature of Egypt’s role as an LNG exporter.

The Future of Egypt as an LNG Exporter is Uncertain

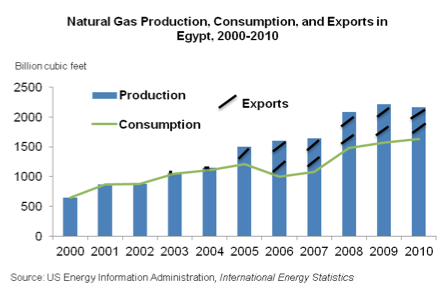

After Algeria, Egypt is the second-largest natural gas producer in Africa. Egypt has long been an important natural gas provider to Europe and the Mediterranean region. In the years prior to the Arab Spring uprising in 2011, however, exports started to compete with rising domestic demand. (Figure 5)

Figure 5 Egypt’s Natural Gas Production, Consumption, and Exports

In terms of Egypt’s LNG export capacity, two new LNG projects (a total of three trains) have come on-line during the past few years – the Spanish Egyptian Gas Company (SEGAS) LNG Train 1 located in Damietta, Egypt and Egyptian LNG Trains 1 and 2 in Idku (Egyptian LNG).

During the political unrest of 2011 that toppled the Mubarak regime, there was minimal impact on the operation of Egypt’s two LNG export facilities, which have a combined export capacity of close to 600 Bcf per year. Since that time, however, Egypt has been suffering from gas shortages and has already halted gas exports to Israel and shut down one of its two LNG plants -- the SEGAS LNG plant at Damietta -- because of a lack of feedstock. In May 2013, the UK’s BG Group, which has played a leading role in the development of Egypt’s natural gas industry and is responsible for around a third of all gas produced in Egypt,[i] indicated that they expected the Egyptian government to continue to allow LNG exports from BG’s Egyptian LNG facility despite Egypt’s current domestic gas shortages. While recognizing that the political and economic environment in Egypt remained challenging, BG also confirmed plans to move forward with additional drilling in the hopes of bringing on new natural gas volumes from Egypt in 2014.[ii]

Just last month, it was reported that Egypt would use five Qatari LNG cargoes it received as “gifts” to pay its foreign partners under a previously announced gas-swap deal. Under the agreement, international oil companies in Egypt started supplying natural gas in mid-May in return for Qatari LNG shipments to be exported to the companies’ clients. Qatar plans to donate the cargoes from the end of July until mid-September with each 3.2 Bcf cargo valued at $30 million to $40 million, depending on the price index.[iii]

There’s no doubt that the evolving situation in Egypt represents a number of uncertainties for the energy sector overall, with increased relevance for the global gas market which is also evolving at a rapid pace as natural gas and LNG continue to play a more important role in the world’s energy market. How these uncertainties will ultimately play out remains to be seen but this much is certain – it’s looking like a long hot summer for Egypt.[v]

Susan L. Sakmar

.png)

[ii] BG DataBook 2012 http://bg-group-databook.com/pdf/BG_DataBook_2012_4_Africa_Central_and_South%20Asia.pdf

[iii] Stuart Elliott, UK's BG sees no impact on Egypt LNG exports despite local shortages, London (Platts), May 2, 2013, available at

[iv] Ola Galal, Egypt to Use Qatari LNG Cargo Gifts to Pay Foreign Partners, Bloomberg, June 13, 2013, available at

[v] Summer Said, Qatar To Give Egypt 5 Free LNG Cargoes This Summer, The Wall Street Journal, June 10, 2013, available at http://online.wsj.com/article/BT-CO-20130610-706242.html, reporting that Egypt has experiences regular power cuts due to natural gas shortages and that the Qatari cargoes come as, “a gift to the Egyptian people during the summer months.”