Coastal GasLink’s mechanical completion paves way for Canadian LNG exports [Gas in Transition]

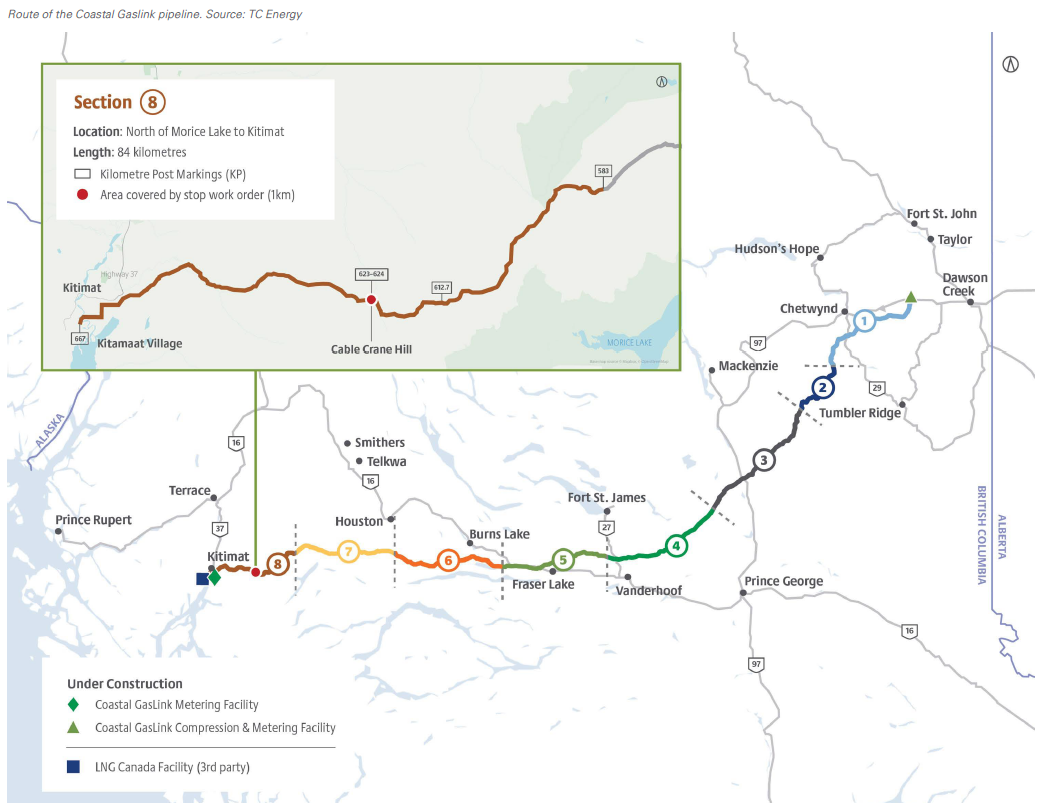

TC Energy announced in November that its 670-km Coastal GasLink pipeline project in British Columbia had achieved mechanical completion ahead of a targeted deadline of the end of 2023. The pipeline will carry gas from the Groundbirch area of the Montney play to the LNG Canada export terminal, which is currently under construction near Kitimat and preparing to enter service in 2025. Completion of the pipeline thus marks a significant milestone for Canada as it prepares to start LNG exports to Asia.

Coastal Gaslink’s pipe installation was completed in October, with the full length of the pipeline also hydrotested and post-construction engineering reviews carried out. With mechanical completion achieved, Coastal GasLink is now completing commissioning activities, with commissioning gas due to be delivered to the LNG Canada facility by the end of the year. In 2024, reclamation work related to the project is set to continue while LNG Canada nears completion.

This comes as building major new oil and gas pipelines has become increasingly challenging across parts of North America, including Canada generally, as well as BC. For such a new pipeline to be preparing to enter service there is unusual at this point, though Coastal GasLink benefited from entering permitting when attitudes to major new fossil fuel projects were comparatively more favourable.

“Coastal GasLink was approved many years ago after much scrutiny and was fully (eventually) backed by regulatory bodies and the provincial and federal governments before the heightened environmental/climate sensitivity was fully in play as it has been in the past few years,” RBN Energy’s managing director of North America energy market analysis, Martin King, tells NGW. He adds that this was also the case for the Trans Mountain oil pipeline expansion, which is under construction and close to completion, reaching the BC coast as well.

“Both CGL and TMX were subject to extensive regulatory analysis and environmental scrutiny which delayed both by at least a couple of years,” says King. “For instance, TMX was approved twice by the same regulatory agency (Canada Energy Regulator) because of environmental pushback and more analysis.”

Delays

Additional regulatory scrutiny is not the only challenge faced by Coastal GasLink, which has also struggled with schedule delays and significant cost overruns. At mechanical completion, the pipeline’s cost estimate was C$14.5bn (US$10.7bn), more than double the initially projected amount of C$6.2bn.

“I think part of the issue for CGL was a lot of input cost inflation, which went way beyond what was expected,” says King. “There were construction challenges along parts of the route that added costs, numerous environmental-related delays, and the delays and costs associated with COVID shutdowns that added a lot of cost to the project.”

“I think part of the issue for CGL was a lot of input cost inflation, which went way beyond what was expected,” says King. “There were construction challenges along parts of the route that added costs, numerous environmental-related delays, and the delays and costs associated with COVID shutdowns that added a lot of cost to the project.”

Indeed, the pipeline entered construction in late 2018, which in turn was made possible by a final investment decision (FID) on LNG Canada. The subsequent onset of the COVID-19 pandemic in 2020 came as a major setback to the project.

“COVID was probably one of the single largest sources of cost inflation for CGL (and TMX),” says King.

On top of this, TC Energy has previously cited “challenging conditions in the Western Canadian labour market; shortages of skilled labour; impacts of contractor underperformance and disputes; as well as other unexpected events like drought conditions and erosion and sediment control challenges” as factors contributing to cost pressures on Coastal GasLink.

Contractor disputes are an ongoing issue even now. A court case is underway as TC Energy pursues C$1.2bn in cost recoveries from a former Coastal GasLink contractor, Pacific Atlantic Pipeline Construction (PAPC). TC Energy terminated PAPC’s contract in 2022, alleging underperformance, and is seeking to recoup the cost of finding a new contractor.

The case is before a court in Alberta, with Coastal GasLink arguing that it is legally entitled to draw on a C$117mn letter of credit, issued by HSBC as a performance guarantee for PAPC.

New era

Even as the dispute continues, though, Coastal GasLink is being welcomed by the Canadian oil and gas industry as a critical piece of infrastructure, which is expected to help boost the country’s gas production and kick-start LNG exports. Indeed, Coastal GasLink could also play a role in the further growth of the LNG industry beyond LNG Canada.

“There are several more LNG projects being proposed or in early construction,” says King. “Cedar LNG is just downstream from LNG Canada (~5 km) and is looking at a potential FID by the end of Q1 2024. The dedicated pipeline for this would be CGL (already constructed), so just a smaller/shorter section of pipeline would have to run from near LNG Canada to Cedar LNG.”

King sees a “very good possibility” that Cedar LNG and its associated short pipeline will go ahead and be up and running by 2028.

Beyond this, further LNG momentum is already being seen on the BC coast, and these projects may look to the experience of LNG Canada and Coastal GasLink for lessons on how to proceed.

“Another project, Woodfibre LNG, is in the early stages of construction and has part of its pipeline already constructed. The company is aiming to be onstream by 2027-28,” says King. “A third project, Ksi Lisims LNG, would be north of Kitimat, near the border with Alaska. This one would need an entirely new pipeline to feed gas to the plant.”

King adds that it is not clear if Ksi Lisims will go ahead and that approval of the pipeline could take several years if an application is submitted.

“Having said all that, the projects and pipelines that are under construction are probably the only ones that will be eventually put into operation,” he says. “The Ksi Lisims project, and a dedicated pipeline for it, seem like a long shot at this stage. There is definite interest in LNG in BC, but there is also a lot of environmental sensitivity in BC to gas/LNG projects, so it is not clear how much of a pushback would occur for new projects/pipes like Ksi Lisims.”

LNG and gas projects are trying to position themselves as playing a positive role in the energy transition by providing a cleaner alternative to coal. Under-construction and planned projects in BC have also been touting various decarbonisation measures as they advance.

Additionally, one of Coastal GasLink’s successes was in winning over the majority of indigenous communities along the pipeline’s route. While Coastal GasLink has faced local protests, TC Energy signed option agreements to sell a 10% equity interest in the Coastal GasLink Pipeline Limited Partnership to 16 out of 20 indigenous communities across the project corridor in 2022. Both Cedar LNG and Ksi Lisims LNG are part-owned by indigenous groups, and this could make it easier for them to advance.

For other gas projects, though, this could be an important lesson to bear in mind, depending on their location. And for major gas pipelines specifically, it could be significantly more challenging to get through regulatory approval processes today than it was a decade ago. But on the other hand, they would not expect to run into the same sort of obstacles that Coastal GasLink did at the start of the pandemic.

“Presumably, if any other pipes get built, they will have to be acutely aware of the higher input costs and won’t have to face pandemic-related slowdowns and stoppages,” says King.