America’s Natural Gas: From Shale Gas To LNG Exports

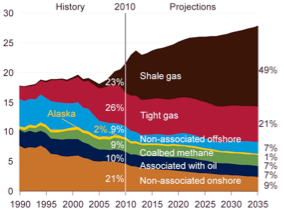

According to the U.S. Energy Information Administration’s (EIA) Annual Energy Outlook 2012, U.S. natural gas production is expected to increase almost twenty-nine percent from 21.6 trillion cubic feet in 2010 to 27.9 trillion cubic feet in 2035. Almost all of the increase is due to the projected growth in shale gas production, which is expected to account for forty-nine percent of total U.S. natural gas production in 2035, more than double its twenty-three percent share in 2010.

Figure 1: U.S. Natural Gas Production 1990-2035 (in trillions of cubic feet)1

Much has been written about shale gas being either an “energy game changer” or an environmental hazard depending on whom you ask. In contrast, far less attention has been focused on whether the U.S. should export its newfound abundance of shale gas as liquefied natural gas (LNG)2 to foreign countries.

Overview of the U.S. Regulatory Approval Process for U.S. LNG Exports

At the outset, it is important to note that under existing U.S. law, export applications to export to most free trade agreement (FTA) countries are deemed to be in the public interest and such applications are quickly authorized by the Department of Energy, Office of Fossil Energy (DOE/FE).3 Most, though not all,4 countries that have an FTA with the U.S. require national treatment for trade in natural gas, including Australia, Bahrain, Canada, Chile, Colombia, Dominican Republic, El Salvador, Guatemala, Honduras, Jordan, Mexico, Morocco, Nicaragua, Oman, Peru, Republic of Korea and Singapore.5 In addition, the U.S. has ratified a FTA that requires national treatment for trade in natural gas with Panama, which has not taken effect as of May 15, 2012.6

With the exception of the Republic of Korea, most of the FTA countries are not likely to be significant importers of natural gas so the real prize for a company is the authorization to export natural gas to any country, which the DOE/FE refers to as “non- FTA” countries. Applications for export authorization to non-FTA countries involve greater scrutiny and require a determination of whether the proposed exports are in the “public interest.” In evaluating whether a proposed export is within the public interest, the DOE/FE applies certain Policy Guidelines issued in 1984 that focus the analysis on:7

- The domestic need for the natural gas proposed to be exported;

- Whether there is a threat to the domestic security of supply; and

- Other factors to the extent they are shown to be relevant to a public interest determination.

Politics and Pending LNG Export Applications

In August 2012, a bipartisan group of lawmakers, including ten Democrats and thirty-four Republicans from Texas, Louisiana, Arkansas, and Oklahoma increased pressure on the Obama administration to speed up DOE/FE approval for a number of pending LNG export applications. In a letter to Energy Secretary Steven Chu, the lawmakers pointed out that the DOE/FE “does not seem to have a set timeline for decisions or a sense of urgency,” which has left a growing number of companies and projects waiting in limbo.8

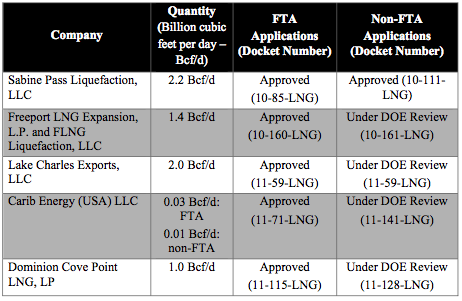

Table 1: Applications Received by DOE/FE to Export Domestically Produced LNG from the Lower-48 States (as of October 26, 2012)9

.png)

But, in an election year, it seems that politics dominates everything and the prospect of exporting U.S. LNG has increasingly become a political hot button. The political debate over whether the U.S. should export LNG began to mount last fall when concerns were raised that allowing LNG exports would lead to an increase in the domestic price of natural gas.10 Exports are one of many factors that can have a bearing on the price of domestic gas, since they represent an additional source of demand. At the same time, over the long run, an increase in demand also tends to increase supply. The extent to which the price of natural gas interacts with its supply and demand has been a cause of much speculation in the U.S., leading to a U.S. Senate hearing in November 2011 to address the issues raised by the possibility of U.S. LNG exports.11

Chairman Bingaman noted in his opening remarks that the last time the Senate held a hearing on LNG was in 2005, when the U.S. anticipated the need to import growing quantities of LNG, whereas the current hearing was meant to discuss the role that LNG exports might play in the energy future of the U.S.12 There were two main objectives of the Senate hearing.13 The first was to understand the laws and regulations that govern LNG exports generally since those laws were put into place assuming the United States would be an importing country, not an exporting country.14

The second objective was to understand how LNG exports might affect the domestic market for natural gas.15 While the implications of increased gas exports for U.S. job creation and balance of payments could be very positive, Chairman Bingaman also noted that U.S. energy security requires reliable and affordable energy prices, not just reliable supply.16 Since U.S. gas prices are considerably lower than prices than those in much of the world, Chairman Bingaman questioned how the U.S. could “ensure that our export policy is consistent with our continued ability to reap the benefits of our newfound abundance of natural gas?”17

The Impact of U.S. LNG Exports on U.S. Natural Gas Prices

At the Senate Subcommittee hearing, several Senators expressed concern about the impact LNG exports could have on domestic natural gas prices, including U.S. Senator Ron Wyden (D-OR) who noted,

[I]t’s very understandable why North American natural gas producers would want to build LNG export terminals so they can sell natural gas to Asia and other overseas markets at four or five times the prices here. What’s less clear is how this is going to be beneficial for our businesses and our consumers who are going to have to compete with these prices? [sic]18

In response to questions about the price increase that DOE/FE would find acceptable, the DOE/FE acknowledged the analysis was complicated and when the DOE/FE makes a public interest determination, it considers a range of factors such as the impact on jobs, balance of trade, and the impact on price.19 Since some of the factors are influenced by price itself, the DOE/FE explicitly recognized the importance that price holds.20

In order to address the potential cumulative impact of granting the pending export applications, the DOE/FE indicated that it had commissioned two pricing studies that, taken together, “will address the impacts of additional natural gas exports on domestic energy consumption, production, and prices, as well as the cumulative impact on the U.S. economy, including the effect on gross domestic product, jobs creation, and balance of trade, among other factors.”21

What Do The Pricing Studies Show?

In January 2012, the U.S. EIA released the first pricing study analyzing the impact of U.S. LNG exports on the domestic energy market.22 As requested by the DOE/FE, the EIA’s study reviewed the impact of specified scenarios of natural gas exports on U.S. energy markets, focusing on consumption, production, and prices.23 The study was not intended to give an estimate of what LNG exports would likely be in the future, but to assume that the levels of exports would be either six billion cubic feet per day (Bcf/d) or twelve Bcf/d, discounting other possible scenarios.24 In summary, the U.S. EIA concluded that, “increased natural gas exports lead to higher domestic natural gas prices, increased domestic natural gas production, reduced domestic natural gas consumption, and increased natural gas imports from Canada via pipeline.”25

On the issue of the impact of exports on U.S. natural gas prices, the EIA noted that U.S. natural gas prices are expected to increase even before considering the possibility of additional exports.26 Nonetheless, increased natural gas exports are expected to lead to higher domestic natural gas prices, although the precise amount depends on the ultimate level of exports and the rate of phasing in increased exports.27 For example, under the low-slow scenario, it is assumed that six Bcf/d of exports are phased in at a rate of one Bcf/d per year over six years.28 Under this scenario, the wellhead price impacts peak at about 14% ($0.70/Mcf) in 2022, but the wellhead price differential falls below 10% by about 2026.29 Although the impact of LNG exports varies depending on the assumptions about resource availability and economic growth, the basic assumption remains the same: “higher export levels would lead to higher prices, rapid increases in exports would lead to sharp price increases, and slower export increases would lead to slower but more lasting price increases.”30

In contrast to the potentially severe impacts on price found in the EIA study, an independent assessment done by Deloitte MarketPoint LLC found that any price increase resulting from U.S. LNG exports would be quite minimal.31

In May 2012, the Brookings Institution released a report analyzing the various pricing studies that have been conducted so far on the impact of U.S. LNG exports on the domestic price of natural gas.32

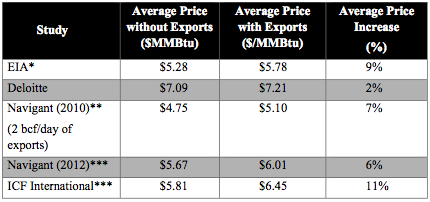

Table 2: Study-by-study comparison of the Average price Impact from 2015-2035 of 6 bcf/day of LNG exports (unless otherwise noted) 33

* Price impact figure for EIA study reflects the reference case, low-slow export scenario.

** The Navigant study did not analyze exports of 6 bcf/day.

*** Navigant (2010 and 2012) and ICF International studies are based on Henry Hub price.

As indicated by the Brookings analysis, while the exact pricing impact of U.S. LNG exports is unclear, there is some consensus that LNG exports will lead to an increase in the domestic price of natural gas.34 The impact of such price movements on U.S. energy policy and regulatory framework is unclear. Brookings advocates for the approval of export applications assuming that the nature of the LNG sector (in terms of the costs associated with producing, processing, and shipping the gas) and the global market in which it will compete, will place upper bounds on the amount of LNG that will be economically advantageous to export from the U.S.35

Pending Congressional Bills to Limit LNG Exports

While the delay in the DOE approval process for pending LNG export applications has caused market uncertainty for projects awaiting approval, it has also allowed more time for other opponents to voice concerns about the impact of U.S. LNG exports. For example, U.S. Representative Ed Markey (D-Mass.) has introduced two bills in Congress with the stated purpose of protecting U.S. consumers from increased natural gas prices and ensuring that America’s natural gas stays in America.36 The first bill, the “North America Natural Gas Security and Consumer Protection Act”37 would preclude the Federal Energy Regulatory Commission from approving new LNG export terminals. The second bill, the “Keep American Natural Gas Here Act,”38 would require natural gas extracted from federal lands to be resold only to American consumers. Subsequent to the approval of Cheniere’s Sabine Pass project, Congressman Markey issued a press release continuing to express his concern that U.S. LNG exports would increase domestic prices for natural gas, harming individual and industrial users of natural gas.39

Congressman Markey is not alone in his view that “America should exploit her competitive advantage with lower natural gas prices to create jobs in the United States.”40 Leaders from other industries have called on the U.S. to use its cheap natural gas to convert to products for export, as opposed to exporting the natural resource itself. For example, the CEO of Dow Chemical has argued that U.S. LNG exports should be limited since there is up to eight times more value in using America’s abundant and cheap natural gas as the raw material to create high-value products that can be exported, as opposed to simply exporting the natural gas itself.41

Will Environmental Opposition to Shale Gas Development Hinder LNG Exports?

In additional to political opposition to U.S. LNG exports, there is some risk that environmental opposition to shale gas development will spill over into opposition to U.S.

LNG exports. For example, the Sierra Club has opposed a number of LNG export projects and has argued that the environmental impacts associated with natural gas production must also be considered in determining whether U.S. LNG exports are in the “public’s interest.”42 While the Sierra Club contends that all environmental impacts from natural gas production need to be considered, their brief highlighted particular environmental concerns pertaining to hydraulic fracturing and shale gas development.43 In summary, the Sierra Club maintains that DOE’s approval for LNG exports could have “major environmental impacts through the [United States], and especially in the Northeast, where [U.S. LNG exports] will intensify Marcellus Shale extraction activities.”44

The Sierra Club’s opposition to LNG export projects coincides with its intensified effort to ensure that, as coal fired power plants are retired, they are not replaced with natural gas power plants.45 To that end, the Sierra Club recently announced that it is launching a new “Beyond Gas” campaign that represents a significant expansion of the group’s on-going efforts against other major fossil fuels and is modeled after the decade- old “Beyond Coal” campaign that sought to phase out coal fired power plants.46 According to the Sierra Club, it will seek to “prevent new gas plants from being built wherever we can.”47

It remains to be seen whether the environmental opposition to U.S. LNG exports will intensify. However, some reports have acknowledged that since the case for U.S. LNG exports depends on the continued development of shale gas, the public’s concerns over the environmental impacts of shale gas development must be resolved.48

Will Political Pressure Spur Action on Pending Export Applications?

Some policymakers and business leaders have urged the U.S. to approve the export licenses and have expressed the view that the market should dictate whether U.S.

LNG exports happen or not.49 For example, at the November 2011 Senate hearing, Senator Lisa Murkowski (R-Alaska), indicated she is inclined to let the market sort out the issue and stated that “our proper course won’t be sweeping legislation or layers of new regulation. Instead, it will be to ensure a degree of comfort that our newfound energy security can be maintained under current export rules.”50

The DOE/FE appears to be in no hurry to decide the pending export applications or release a much-anticipated second study addressing the economic impacts of LNG exports, which was originally expected in early 2012, but is now delayed until sometime later in 2012.51 Moreover, DOE/FE recently posted an update on its website indicating that the economic impacts study will be open to public comment which will likely result in additional delays.52 In the meantime, it is open to debate whether U.S. LNG exports are in the “public’s interest” or not.

This article by Susan L. Sakmar was republished with permission from the Harvard Business Law Review

* Visiting Assistant Professor and Andrews Kurth Energy Law Scholar, University of Houston Law Center; Adjunct Professor, University of San Francisco School of Law; licensed attorney in State of California.

1 U.S. Energy Info. Admin., Annual Energy Outlook 2012 (Early Release) fig. 2 (Jan. 2012), available at http://www.eia.gov/forecasts/aeo/er/pdf/0383er%282012%29.pdf.

2 LNG is natural gas that has been cooled until it reaches a liquid state, which then allows it to be transported. LNG is usually shipped on special LNG tankers but it can also be transported via truck or container.

3 15 U.S.C. § 717b (2006).

4 For example, Costa Rica and Israel do not require national treatment for trade in natural gas. U.S. Dep’t of Energy, How to Obtain Authorization to Import and/or Export Natural Gas and LNG (Sept. 26, 2012), http://www.fossil.energy.gov/programs/gasregulation/How_to_Obtain_Authorization_to_Import_an.html.

5 Id.

6 Id.

7 Policy Guidelines and Delegation Orders Relating to the Regulation of Imported Natural Gas, 49 Fed. Reg.

6,684 (Feb. 22, 1984).

8 Letter from James Lankford, U.S. Rep., et al., to Steven Chu, Sec’y, Dep’t of Energy (Aug. 7, 2012), http://lankford.house.gov/sites/lankford.house.gov/files/Sec%20Chu%20LNG%20Export%20Suppport%20Letter% 20TX%20OK%20LA%20AR0001.pdf.

9 Office of Oil and Gas Global Sec. and Supply, Office of Fossil Energy, U.S. Dep’t of Energy, Applications Received by DOE/FE to Export Domestically Produced LNG from the Lower-48 States (as of Oct. 26, 2012), http://www.fossil.energy.gov/programs/gasregulation/reports/Long_Term_LNG_Export_10-26-12.pdf.

10 See, e.g., Benjamin Lefebvre, Should the U.S. Export Natural Gas?, Wall St. J., Sept. 16, 2012, at R10, available at http://online.wsj.com/article/SB10000872396390444226904577561300198957854.html (featuring debate on potential price increases by two energy analysts).

11 LNG Export Approvals, Market Impact: Hearing Before S. Subcomm. on Energy and Natural Res. (Nov. 8, 2011) (opening statement of Chairman Bingaman), http://www.energy.senate.gov/public/index.cfm/democratic- news?ID=242b6b91-cb66-49f5-a4bb-8b2dc54d89e1.

12 Id.

13 Id.

14 Id

. 15 Id.

16 Id.

17 Id.

24 Id.

25 Id. at 6.

26 Id.

27 Id.

28 Id. at 8.

29 Id.

30 Id. at 9.

31 Deloitte MarketPoint LLC and the Deloitte Ctr. for Energy Solutions, Made in America: The economic impact

of LNG exports from the United States (Dec. 2011), available at http://www.deloitte.com/assets/Dcom- UnitedStates/Local%20Assets/Documents/Energy_us_er/us_er_MadeinAmerica_LNGPaper_122011.pdf.

32 Charles Ebinger et al., Brookings Institution Energy Security Initiative, Liquid Markets: Assessing the Case for U.S. Exports of Liquefied Natural Gas (May, 2012), available at http://www.brookings.edu/research/reports/2012/05/02-lng-exports-ebinger.

33 Id. at 33.

34 Id.

35 Id. at vi–vii.

36 Press Release, Natural Res. Committee, Markey Introduces Legislation to Keep American Natural Gas in America (Feb. 14, 2012), http://democrats.naturalresources.house.gov/press-release/markey-introduces-legislation- keep-american-natural-gas-america.

37 H.R. 4024, 112th Cong., 2nd Sess. (2012), http://www.govtrack.us/congress/bills/112/hr4024.

38 H.R. 4025, 112th Cong., 2nd Sess. (2012), http://www.govtrack.us/congress/bills/112/hr4025.

39 Press Release, Congressman Ed Markey, Markey: Sabine LNG Export Facility Approval Would Help Export

U.S. Manufacturing Jobs (Apr. 17, 2012), http://markey.house.gov/press-release/markey-sabine-lng-export-facility- approval-would-help-export-us-manufacturing-jobs.

40 Kate Winston, Senators question price impact of LNG exports, Platts Energy Week, Nov. 9, 2011, http://www.wusa9.com/news/local/story.aspx?storyid=174167.

41 Christopher Helman, Dow Chemical Chief Wants to Limit U.S. LNG Exports, Forbes, Mar. 8, 2012, http://www.forbes.com/sites/christopherhelman/2012/03/08/dow-chemical-chief-wants-to-limit-u-s-lng-exports/ (citing Dow Chemical CEO Andrew Liveris).

42 Sierra Club’s Motion to Intervene, Protest, and Comments, Dominion Cove Point LNG, LP., FE Docket No. 11-128-LNG, (Feb. 6, 2012), http://www.fossil.energy.gov/programs/gasregulation/authorizations/2011_applications/Motion_to_Intervene_Sierra _Club_02_06_12.pdf.

43 Id. at 22–24.

44 Id. at 47.

45 Amy Harder, War Over Natural Gas About to Escalate, Nat’l Journal, May 3, 2012,

http://www.nationaljournal.com/energy-report/war-over-natural-gas-about-to-escalate-20120503. 46 Id.

47 Id.

48 See Ebinger, supra note 32, at 9–10.

49 Tennille Tracy, U.S. Gas Exports Put on Back Burner, Wall St. J., May 31, 2012, at B3, http://online.wsj.com/article/SB10001424052702304821304577436470209675022.html.

50 See Sakmar, supra note 18.

51 Id.

52 U.S. Dep’t of Energy, Status of LNG Export Study, Natural Gas Import & Export Regulation,

http://fossil.energy.gov/programs/gasregulation/ (last visited Nov. 14, 2012).